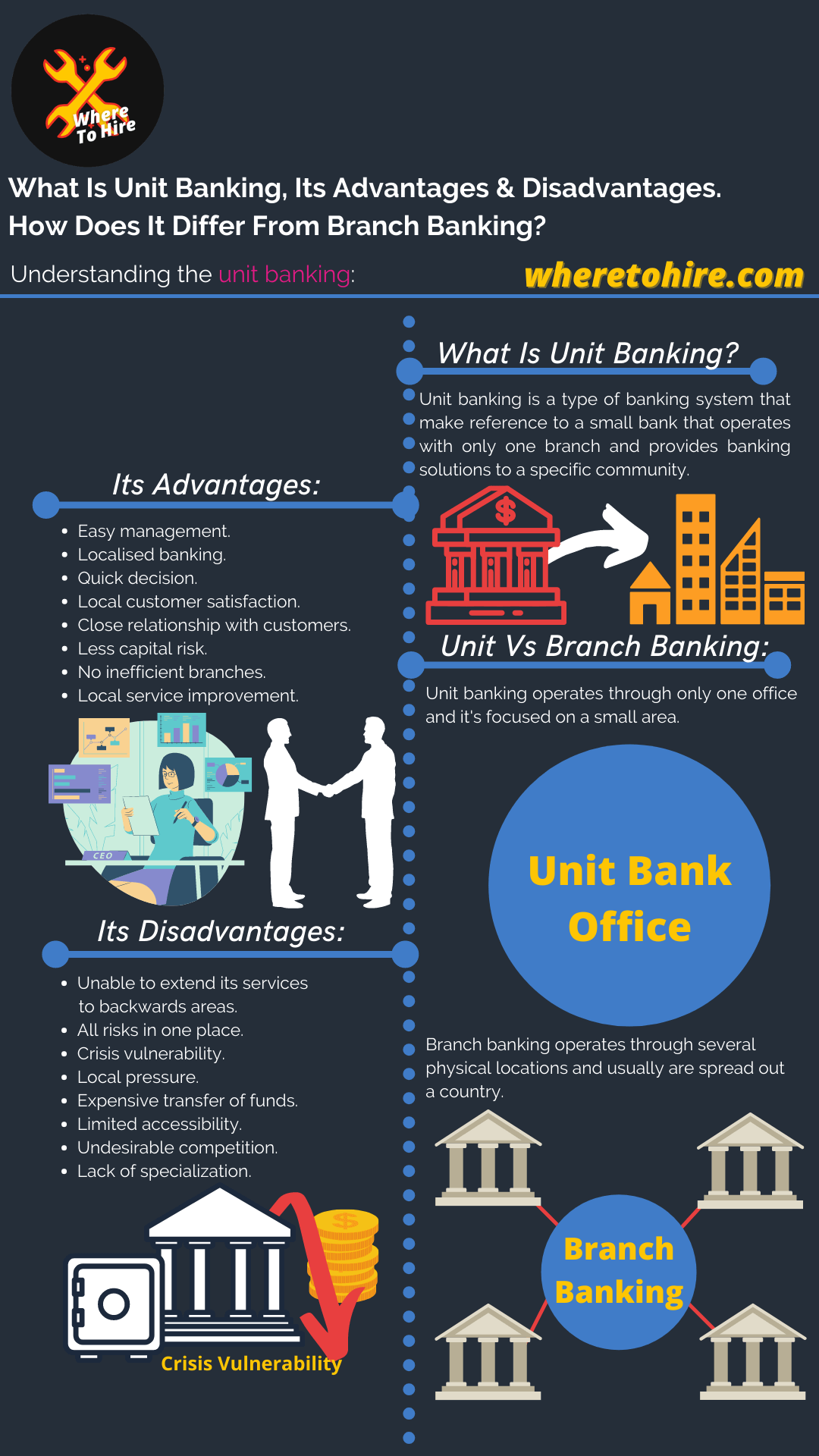

What Is Unit Banking And Its Advantages You Should Know?

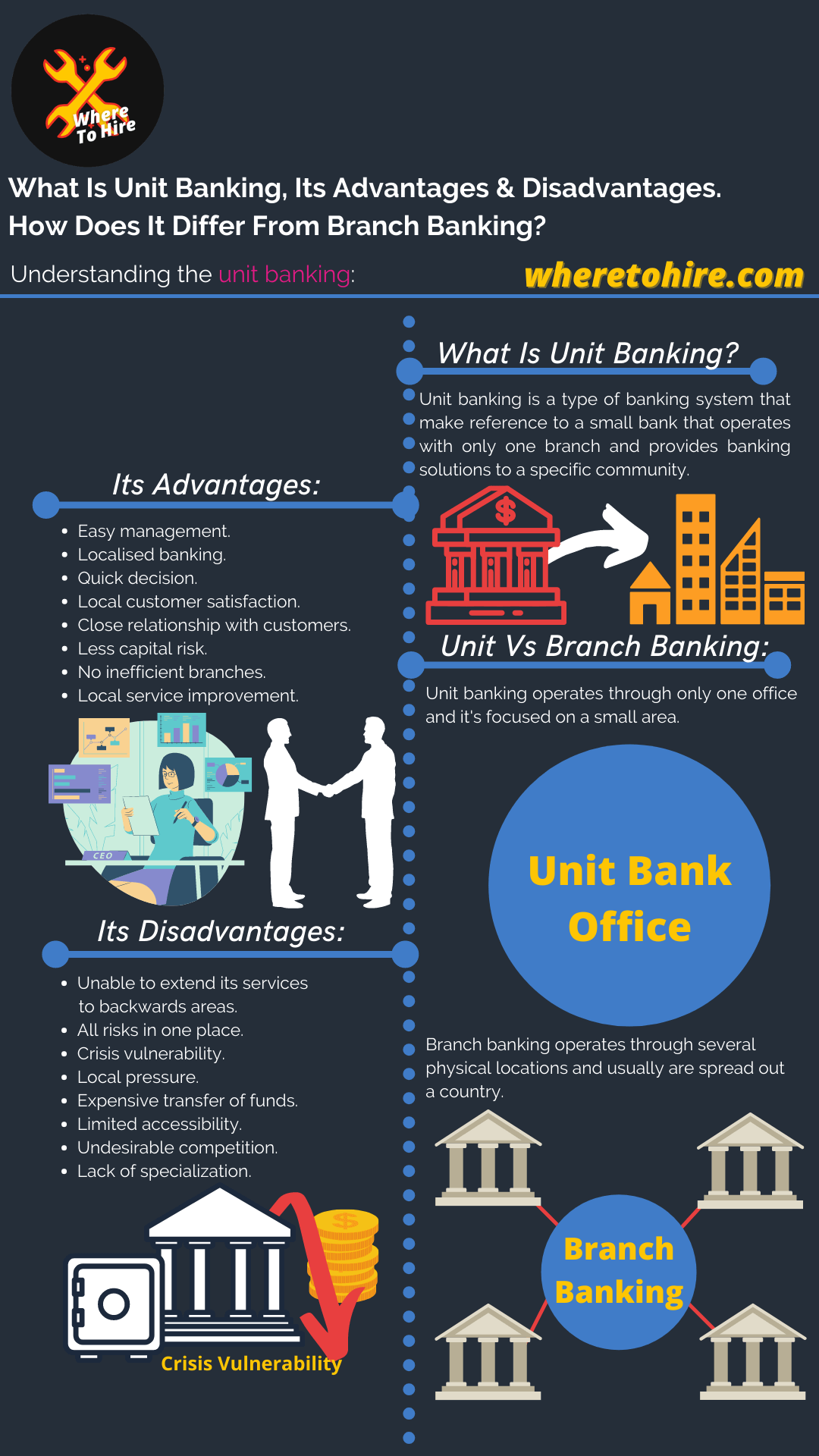

What is unit banking? Unit banking is a type of banking system that make reference to a small bank that operates with only one branch and provides banking solutions to a specific community. The unit banking system was originated in United States and is also know as localised banking.

What are the advantages of unit banking?

1. Easy management

Since the unit banking system is operated through a single branch, it's easier to make decision about the operations of the bank.

2. Localised banking

This is the kind of bank that better knows the needs and problem of a community, because they're focused on providing financial services on a small and specific geographic area.

Consider this particular advantage whenever you are aware that you will not need to travel frequently away from your residence.

3. Quick decision

In this system, the bank can make decisions on its own and without depending on a superior central, which means that there will be no delays in banking processes or procedures.

4. Local customer satisfaction

The local customers of a unit banking system will be more than happy by receiving a faster and customized service, instead of waiting a long time, which is one of the disadvantages of branch banking entities.

5. Close relationship with customers

Even the manager of a unit banking system can keep a direct contact with customers whether they're individuals or businessmen.

6. Less capital risk

The risk of being a victim of fraud is minimal due to the ease with which such an institution can be managed.

7. No inefficient branches

Since this kind of bank is focused on a specific and small geographic area, there will not be the amount of claims like banks of branches.

8. Local service improvement

The deposits made on localised banks are used to improve the services provided to its local community.

What are the disadvantages of unit banking?

1. Unable to extend its services to backwards areas

Unit banks are not the best for extending their services to areas that lack banking presence.

In this case it's better to consider the credit unions.

2. All risks in one place

Unlike a bank with several branches, which is able to distribute the risk, a single bank-based system concentrates all its risk in one place, which can lead to a severe operational failure that affects the functionality of the bank.

3. Crisis vulnerability

A single bank will not have too much resources as biggest banks to face financial crisis.

4. Local pressure

Interferences in the local community where this financial entity operates may lead to low performance of its functions.

5. Expensive transfer of funds

If you need to transfer money to an account holder it may be more expensive as the account holder may not be from the same unitary bank.

Remember this disadvantage as long as you are someone who use to make transfer funds frequently to other bank accounts.

6. Limited accessibility

As it's a single bank location, in the event you need to move to any other location, you won't be able to access to a physical branch of the same bank as long as you need face to face assistance.

7. Undesirable competition

Unit banks are operated independently by a different management. This fact lead to undesirable competition between other banks of the same type.

8. Lack of specialization

This type of bank does not usually have many team members trained in various types of banking services.

If you need more specialized services for your banking needs, then you'll need to consider a wider choice.

Conclusion

When it comes to serve a specific local community, the unit banking system could be enough in the first instance, but keep in mind that if you need to move frequently, the lack of branches on these banks could be a factor that you should consider.

Unit banks FAQs

Where the unit banking system is popular in?

The unit banks where originated in United States and became popular in the Southwest and Midwest regions of America.