What Are The Best High-Yield Savings Accounts In US?

What are the best high-yield savings accounts in US? When you want to maximize your revenue by saving your money, it's better that you choose those savings accounts which provide you with the highest interest rates.

While there are so many financial entities which provides you with a high number of branches or ATMs, it doesn't necessarily means they will provide you with high performance rates.

According to the FDIC, the national average interest rate is 0.06% as of June 21, 2021.

That said, keep reading to meet a list of best savings account institutions so you can get a higher rate than the national average.

11 Best high-yield savings accounts to maximize your capital

These 11 best high interest savings accounts that we are listing you, are based on their Annual Percentage Yield (APY), customer service, how easily you can get a hold of someone in the event a problem does occur, their minimum deposit required and their fees.

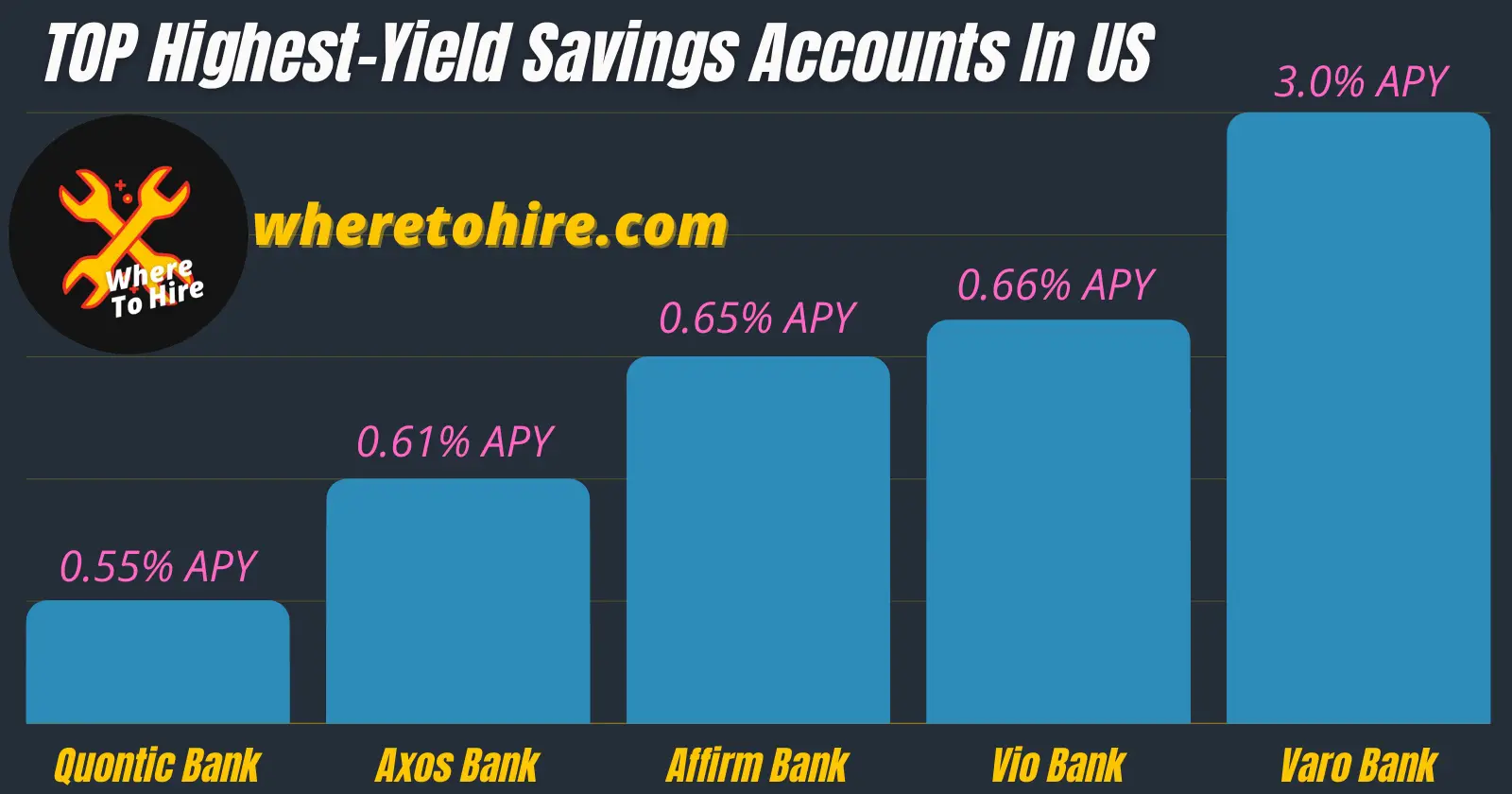

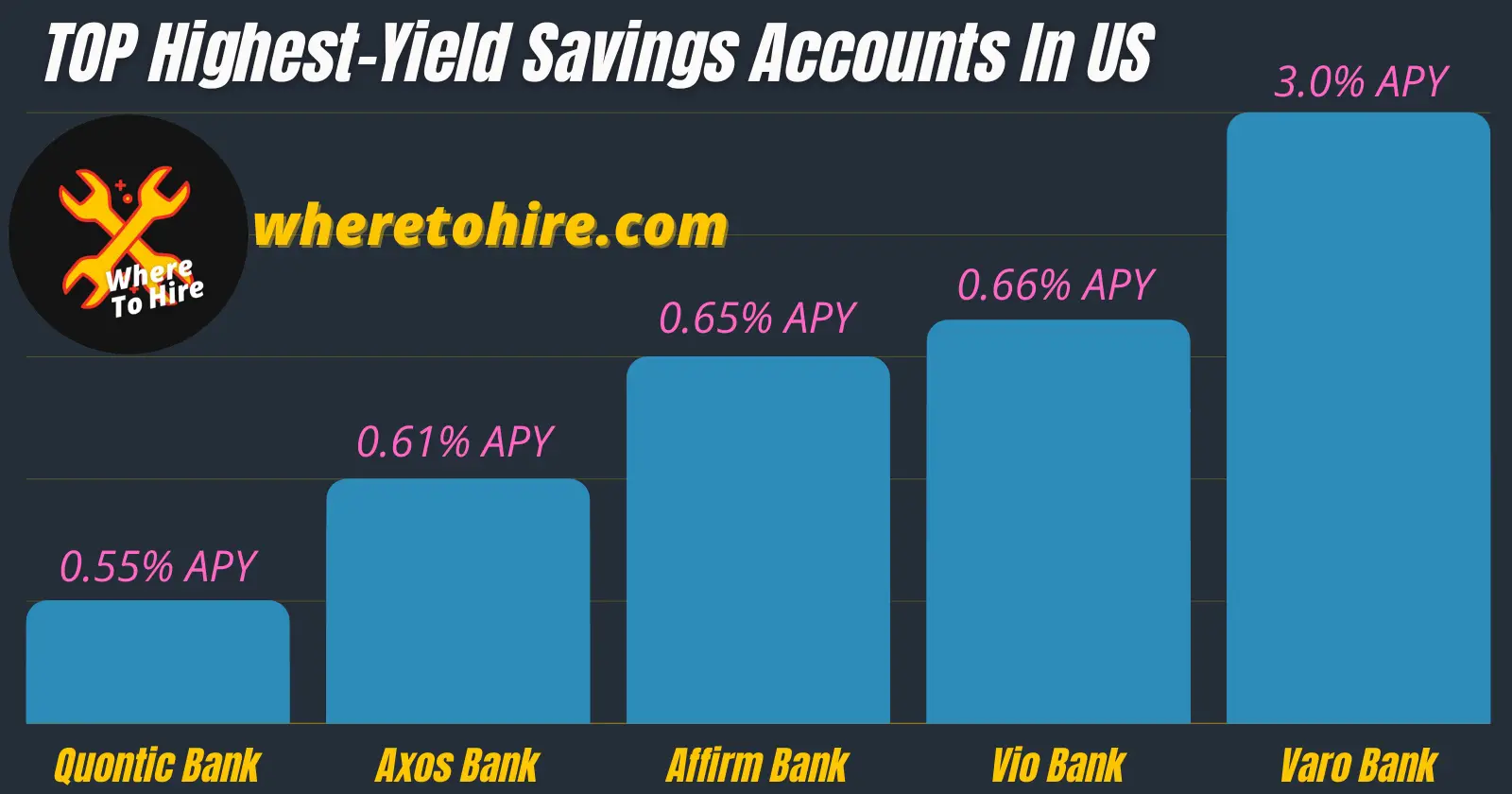

| Institution Name | APY | Min. APY Balance |

| Varo Bank | 3.0% | $0.01 |

| Vio Bank | 0.66% | $100 |

| Affirm Bank | 0.65% | $0 |

| Axos Bank | 0.61% | $0 - $9,999.99 Or $10,000 - $24,999.99 |

| Quontic Bank | 0.55% | $100 |

| Comenity Bank | 0.55% | $25,000 |

| Ally Bank | 0.50% | $0 |

| Chime Bank | 0.50% | $0.01 |

| Live Oak Bank | 0.50% | $0.01 |

| Discover Bank | 0.40% | $0 |

| American Express | 0.40% | $0 |

1. Varo Bank

Varo Bank takes the first place on this list, because you can start with an annual performance yield of 0.20%, but later you can increase your APY up to 1400.0%, which is 3.0% on APY.

That's a huge difference of 4900.0% higher compared to the national average of 0.06%.

Not even some of the best banks in the United States Of America such as Chase or Bank Of America offer you that APY, although their size and assets.

The best part:

Even with this amazing APY, you're free of monthly maintenance fees and you can become a savings account holder with Varo Bank by $0 dollars, while getting access to more than 50,000 free-overdraft fees ATMs across the U.S.

- Highest interest rates.

- No monthly fees.

- No minimun requierements for opening a savings account.

- You'll need to pay third-parties to save deposit cash.

- So you can get the 3.0% APY, it's necessary that you receive a least total qualifying direct deposits of at least $1,000 dollars.

- Savings account holder with a balance higher than $10,000 are not eligible for the 3.0% APY.

2. Vio Bank

Vio Bank offers one of the best high-yield online savings accounts, since it's 0.66% APY. This means that it's 1000% higher if we compare it to the national average.

The most interesting:

This rate apply to all account balances and you only need $100 dollars to open this account, while enjoying the peace of mind that you won't be paying hidden monthly fees.

But there is a couple of small fees to watch out for it, which are super easy to avoid.

What are we talking about?

We mean that as long as you request paper statements, you'll be charged monthly by $5 dollars, so if you want to save those $5 dollars, you only need to conform with digital statements.

Keep in mind that in the event you perform more than 6 withdrawals per month, then you'll be charged by a fee of $10 per transaction.

- High rate applied no matter what's the account balance.

- Lack of mobile service.

- Lack of physical presence.

3. Affirm Bank

It offers 0.65% APY, which is 983.3% higher compared to the national average.

Just one thing to keep in mind:

This account is only available and accessible via the mobile app, so you will need to download the app to open an account.

In addition, they have no minimum dollar requirement and absolutely no monthly fees.

- Competitive APY.

- Easy to sign up for an account.

- Mobile app easy to use.

- You can't make more than six ACH withdrawals per month on savings account.

4. Axos Bank

This bank offers an APY of 0.61%, which is 916.6% higher compared to the national average.

This APY is eligible for a range of balance from $0 - $9,999.99 or $10,000 - $24,999.99.

It's 3 branches spread out in San Diego, California, Las Vegas, Nevada and Columbus, Ohio.

To open an account with this entity, you'll need to deposit at least $250, but later on, you can forget about monthly maintenance fees.

- Online platform to manage your account.

- Competitive APY.

- Limited number of branches.

- You can't access to the 0.61% APY if own over $9,999.99 in your account balance.

5. Quontic Bank

Quontic started out being named as Golden First Bank. It is a digital bank that stands out by offering an APY of 0.55%, which is 816.6% higher compared to the national average.

Something to consider of this savings account, is the common limit of 6 withdrawals per month like other savings account providers we are citing on this post.

They operate Monday through Friday at 9:00 AM - 6:00 PM. Saturday and Sunday closed.

- Only $100 for a savings account.

- No hidden fees.

- Several customer care channels.

- Limited office hours.

- Limit of 6 withdrawals per statement cycle.

6. Comenity Bank

Just like Quontic Bank, Comenity Bank offers a 0.55% of APY, which is the same 816.6% higher compared to the national average.

Be aware that if you want to deposit more than $10 million dollars, then it will necessary that you search somewhere else, since it allows account holders to have a maximum deposit of $10 million dollars.

Unlike other savings account providers cited on this list, its office hours are wider, since this bank operates at 7:00 AM - 11:00 PM Monday through Friday, while on weekends and most of holidays, its office hours are 9:00 AM - 5:00 PM.

- Wider office hours for customer care.

- Account holders have a deposit limit of up to $10 million.

- You need at least $25,000 of balance for APY.

7. Ally Bank

Ally savings account offers an APY of 0.50%, which is 733.3% higher compared to the national average.

An outstanding feature of this savings account, is its daily compounded interests.

This means that you can make more money on your interest compared to another bank accounts that are compound in a monthly frequence.

- Online savings account.

- Online tools to manage your savings.

- No hidden fees.

- Charge of $10 per transaction if is exceeded the limit of 6 transaction.

8. Chime Bank

Chime Bank offers you access up to 0.50% APY, which is 733.3% higher compared to the national average.

Thy also have no minimum deposit required to open an account and $0 dollars on monthly fees.

- No hidden fees.

- No overdraft-charges.

- Mobile banking.

- Lack of branches.

9. Live Oak Bank

Live Oak Bank offers an APY of 0.50%. It's APY is 733.3% higher compared to the national average.

Consider not having less than $10.01 in your account and lack of activity within 24 months, since it drives into account termination.

They operate Monday through Friday at 8:00 AM - 8:00 PM, but closed on weekend.

- Easy to use online platform for opening your account.

- No maintenance fees.

- Only need $0.01 in the account balance to earn interests.

- Limited office hours.

10. Discover Bank

Discover's online savings account offers an APY of 0.40%, which is 566.6% higher compared to the national average.

There are not monthly fees or minimum balance required so you can earn interests.

- Access to over 60,000 no-fee ATMs.

- Mobile Discover App to make check deposit easily.

- ATM Finder.

- Limited number of branches.

11. American Express

American Express is well known for its credit cards.

If you like to keep a lot of your banking under the same banner, American Express offers a savings account at a very competitive rate of 0.40%.

This APY is 566.6% higher compared to the national average.

You won't need to carry out minimum deposits to become into an AmEx account holder, nor monthly fees.

The big difference:

Unlike Vio Bank, AmEx doesn't charge you if you exceed the 6 withdrawals in a month.

- AmEx ranks highest in customer satisfaction according to J.D. Power as of 2020.

- No fees by exceeding 6 withdrawals in a month.

- Customer service 24/7.

- Limited to be only a savings account, no other additional services available.

Conclusion

Now you already know what are the highest-yield savings accounts to increase your revenue.

Consider that additional charges by exceeded withdrawals can be avoid by just not touching your money.

If you are a good user of technology, it will be an advantage for you, since you won't need to pay for print statements and feel comfortable with electronic statements.

Best high-yield savings accounts FAQs

What is a high yield savings account?

A high-yield savings account is a savings account which offers you higher interest rates than the average interest on the banking market.

Is a high-yield savings account worth it?

Yes. A high-yield savings account is worth it as long as you want to get a better revenue through your savings, since the interest rates could be at least 566.6% higher than traditional savings account.

What is the downside of a high-yield savings account?

The drawback of a high-yield savings account depends of the institution where you open your account, since it could mean a lack of branches, limited location or additional charges by withdrawing money.