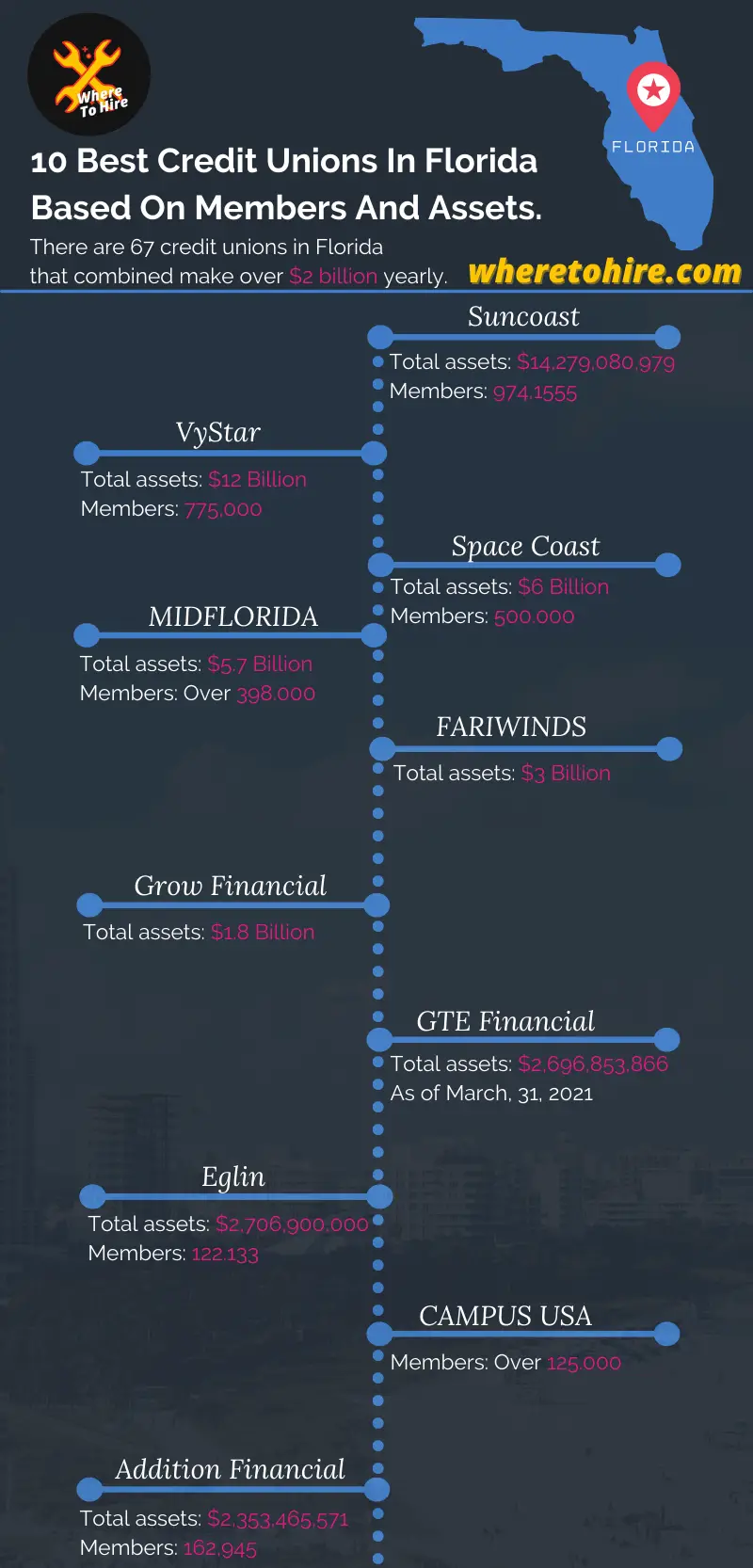

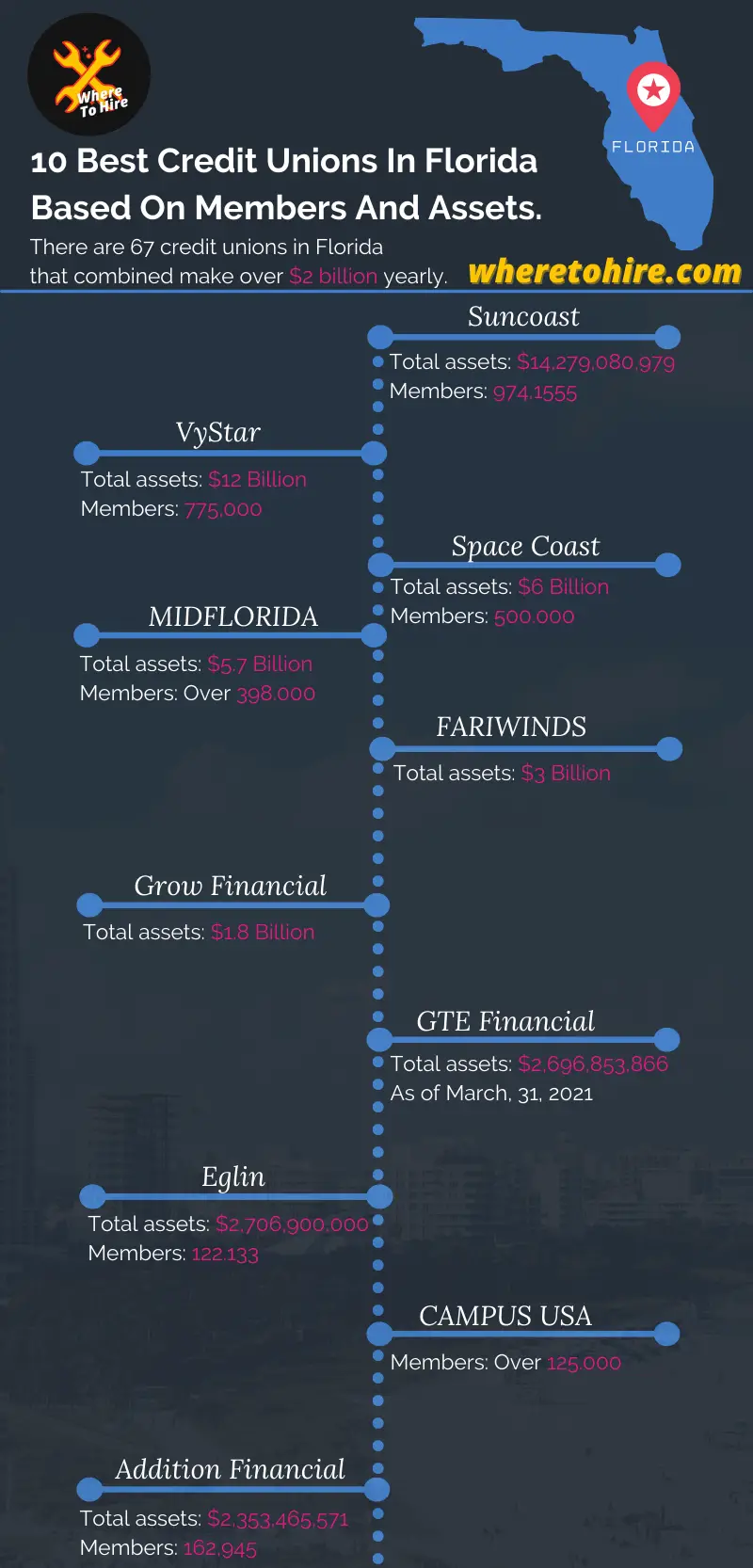

The Best Credit Unions In Florida To Get Better Rates In 2021

What are the best credit unions in Florida? If you're living in Florida and want to low your rates in terms of financial services, you should consider a not-for-profit cooperative or better known as credit union.

In fact, the average APRs in Florida are 3.62% for auto loan, 12.03% for credit cards, while 3.69% for mortgages.

That's why we'll provide you a list of credit unions in Florida to save money in the event you need the support of financial services.

The best and largest credit unions in Florida

As a key takeaway, the 67 Floridian credit unions that exist, combined make over $2 billion yearly according to Cause IQ.

1. Suncoast Credit Union

It started in 1934 by a small group of local educators and today suncoast defines itself as the largest credit union in Florida.

Having $14,279,080,979 in assets and 974,155 members as of June, 30, 2021, it's 73 branches locations, while you'll have access 30,000 ATMs in the CO-OP ATM network.

To become a member you'll need to live in any of the following counties:

- Alachua.

- Brevard.

- Broward.

- Charlotte.

- Citrus.

- Clay.

- Collier.

- DeSoto.

- Dixie.

- Duval.

- Gilchrist.

- Glades.

- Hardee.

- Hendry.

- Hernando.

- Highlands.

- Hillsborough.

- Indian River.

- Lake.

- Lee.

- Leon.

- Levy.

- Manatee.

- Marion.

- Martin.

- Miami-Dade.

- Monroe.

- Orange.

- Osceola.

- Palm Beach.

- Pasco.

- Pinellas.

- Polk.

- Sarasota.

- Seminole.

- St. Johns.

- St. Lucie.

- Sumter.

- Volusia.

Its rates:

- APR for auto loans: 2.75%.

- APR for credit cards: 9.90%.

- APR for mortage: 2.81%.

2. VyStar Credit Union

It started more than 70 years ago and today this is the second largest credit union in Florida, since it owns over $12 billion in total assets and 775,000 members.

Members of this financial entity will have access to more than 20,000 ATMs nationwide, 61 service centers, 18 high school branches, and over 235 VyStar ATMs spread out in Georgia and Florida.

If you live in any of the following Florida's counties, then you'll be eligible to join this cooperative:

- Washington.

- Union - Volusia - Walton - Wakulla.

- St. Johns - Sumter - Suwannee - Taylor.

- Polk - Putnam - Santa Rosa - Seminole.

- Orange - Osceola - Pasco - Pinellas.

- Madison - Marion - Nassau - Okaloosa.

- Lake - Leon - Levy - Liberty.

- Holmes - Jackson - Jefferson - Lafayette.

- Gulf - Hernando - Hamilton - Hillsborough.

- Flagler - Franklin - Gadsden - Gilchrist.

- Columbia - Dixie - Duval - Escambia.

- Brevard - Calhoun - Citrus - Clay.

- Alachua - Baker - Bay - Bradford.

Its rates:

- APR for new cars: As low as 2.74%.

- APR for used cars: As low as 3.74%.

- APR for credit cards: As low as 9.10%.

- APR for home equity: As low as 5.625%.

- APR for personal loans: As low as 7.99%.

- APR for mortgages: As low as 1.932%.

- APY for checking accounts: 0.10%.

- APY for money market: Up to 0.40%.

- APY for CDs: Up to 1.10%.

3. Space Coast Credit Union

SSCU started in 1951 providing financial services to 27 members.

Today it's the third largest credit union in Florida, since it owns more than $6 billion in assets and over 500k members.

It provides you access to 64 branches spread out in Florida's east coast.

You'll be able to join them as long as you live, work, worship or study on any of the following counties:

- Volusia.

- Sumter.

- St. Lucie.

- St. Johns.

- Seminole.

- Putnam.

- Polk.

- Pinellas.

- Pasco.

- Palm Beach.

- Osceola.

- Orange.

- Okeechobee.

- Nassau.

- Monroe.

- Miami-Dade.

- Martin.

- Marion.

- Manatee.

- Lee.

- Lake.

- Indian River.

- Hillsborough.

- Flagler.

- Duval.

- Collier.

- Clay.

- Broward.

- Brevard.

Its rates:

- APR for auto loans: As low as 1.89%.

- APR for mortages: As low as 2.458%.

- APR for credit cards: As low as 9.24%.

- APY for certificates: As high as 1.0%.

- APY for checking: As high as 0.10%.

4. MIDFLORIDA Credit Union

MIDFLORIDA was born in 1954 when the Polk County teachers needed a financial cooperative.

This cooperative reached over $5.7 billion in assets and more than 398,100 members.

It's over 60 branches that extend from the Tampa Bay to the Treasure Coast and 79 ATMs.

Memberships are open to people living in any of their service areas.

You can get with this cooperative the following rates:

- APR for auto loans: As low as 2.83%.

- APR for personal loans: As low as 9.77%.

- APR for home equity loans: As low as 4.13%.

- APY for share secured loan: As high as 4.01%.

- APY for relationship checking account: As high as 0.01%.

- APY for investor checking account: As high as 0.25%.

- APY for extreme yield personal savings account: As high as 0.25%.

5. FARIWINDS Credit Union

This entity was established in 1949, their central offices are located in Orlando, FL and today it's around $3 billion in assets.

FAIRWINDS serves to people nationwide and around the world. You can join it by $5 share membership ragardless where you live in United States.

This financial entity has 31 branches spread out in counties such as Lake, Orange, Osceola, Seminole, Volusia.

Its rates:

- APY for high emergengy savings: As high as 2.021%.

- APY for invertors savings: As high as 0.550%.

- APR for 15-year mortgage: As low as 2.126%.

- APR for 36-month auto loan: As low as 1.75%.

6. Grow Financial Federal Credit Union

Grow Financial was established in 1955 and today it's over $1.8 billion in assets.

Members will have access to their 18 branches spread out in West Central Florida and the Columbia and Charleston areas of South Carolina.

Memberships are open to:

- Organizations with a 501(c)(3) designation

- Those whose programs support either financial, education, social, physical and/or health strategies

- Organizations located within the credit union footprint.

- Organization must be in good standing.

Individual primary education schools will be under lower consideration. This also applies to recreation and sports team programs.

In addition you'll have access up to 70,000 surcharge-free ATMs nationwide.

Its rates:

- APR on fixed rates for new vehicles: Ranging from: 3.15% to 18.0%.

- APR on fixed rates for used vehicles: Ranging from 3.40% to 18.0%.

- APR for fixed rates for signature loans Ranging from 11.45% to 16.45%.

- APR for credit cards: Ranging from 1.99% to 15.74% based on type of credit card plan selected.

- APY for personal checking accounts: 0.00%.

- APY for basic savings account: 0.05%.

7. GTE Financial

This not-for-profit financial cooperative was established in 1935 and it reached $2,696,853,866 in assets as of March, 31, 2021.

Members can access to more than 20 branches and over 30,000 free ATMs in the Tampa Bay area.

You'll only need to be at least 18 years old and provide proof that your are U.S resident.

Its rates:

- APR for auto loans: As low as 2.74%.

- APR for credit cards: As low as 6.74%.

- APR for home loan with 30 years fixed: As low as 3.125%.

- APY for 60 months share certificate: As high as 0.2%.

8. Eglin Federal Credit Union

Also known as EFCU, it was established in 1954.

It has reached the figures of $2,706,900,000.00 in assets and 122,133 members as of July, 31, 2021.

It's 9 branch locations and thousands of surcharge-free ATMs.

Membership is open to:

- Affiliates of Select Employee Groups in Okaloosa, Santa Rosa and Walton counties.

- People workin in the supported locations by EFCU.

- Civilian and military employees of Eglin Air Force Base, Duke Field and Hurlburt Field.

Its rates:

- APR for auto loans: As low as 2.49%.

- APR for boats: As low as 4.75%.

- APR for MASTERCARD: As low as 7.9%.

- APR for home loan with 30 years fixed: 3.375%.

- APR for home loan with 15 years fixed: 2.75%.

9. CAMPUS USA Credit Union

CAMPUS dates back to 1935, when it started as Gainesville Florida Campus Federal Credit Union.

This financial entity provides financial services to over 125,000 members.

It has 18 branches spread out in the Sumter, Columbia, Alachua, Leon and Marion counties.

In terms of ATMs, member can access the CO-OP ATMs network.

To become a member you'll need to perform a deposit of $5 initially a get credit approval. Also you'll need to live or work in any of the following counties:

- Alachua.

- Citrus.

- Clay.

- Columbia.

- Duval.

- Gadsden.

- Gilchrist.

- Hernando.

- Hillsborough.

- Jefferson.

- Lake.

- Leon.

- Levy.

- Madison.

- Marion.

- Nassau.

- Orange.

- Pasco.

- Polk.

- Seminole.

- Sumter.

- Suwannee.

- Taylor.

- Wakulla.

Its rates:

- APR for auto loans: As low as 2.2%.

- APR for motorcycles: As low as 5.13%.

- APR for home equity: As low as 4.55%.

- APR for home equity line of credit: As low as 4.0%.

- APR for credit cards: As low as 7.5%.

- APR for unsucured personal loans: As low as 5.66%.

- APY for savings: As high as 0.15%.

- APY for deposit accounts, campus kids: As high as 0.3%.

- APY for money market checking: As high as 0.5%.

- APY for certificate of deposit: As high as 0.8%.

10. Addition Financial Credit Union

It was named initially as Orange County Teacher's Federal Credit Union, dating back to 1937 when it was established.

This non-for-profit cooperative reached the amount of $2,353,465,571 in assets and 162,945 members by 2020.

It's 26 branch locations and these are the counties where you'll need to live, work, study or worship to join them:

- Volusia.

- Sumter.

- St. Lucie.

- St. Johns.

- Polk.

- Pinellas.

- Pasco.

- Okeechobee.

- Martin.

- Marion.

- Indian River.

- Hillsborough.

- Highlands.

- Hernando.

- Flagler.

- Duval.

- Brevard.

- Alachua.

- Lake.

- Seminole.

- Osceola.

- Orange.

Its rates:

- APR for auto loans: 3.25%.

- APR for credit cards: 8.75%.

- APR for personal loans: 9.00%.

- APR for mortgages: As low as 2.875%.

Conclusion

You already now what are the best financial cooperatives in Florida.

While they provides you with better APRs, you should always consider the eligibility requirements.

Some of them will let you join them regardless of your location in the U.S, but others will consider you eligible as long as you live or work in any of their supported counties.

Best credit unions in Florida FAQs

What is the number one credit union in Florida?

Suncoast, since it has $14,279,080,979 in assets and 974,155 members as of June, 30, 2021.