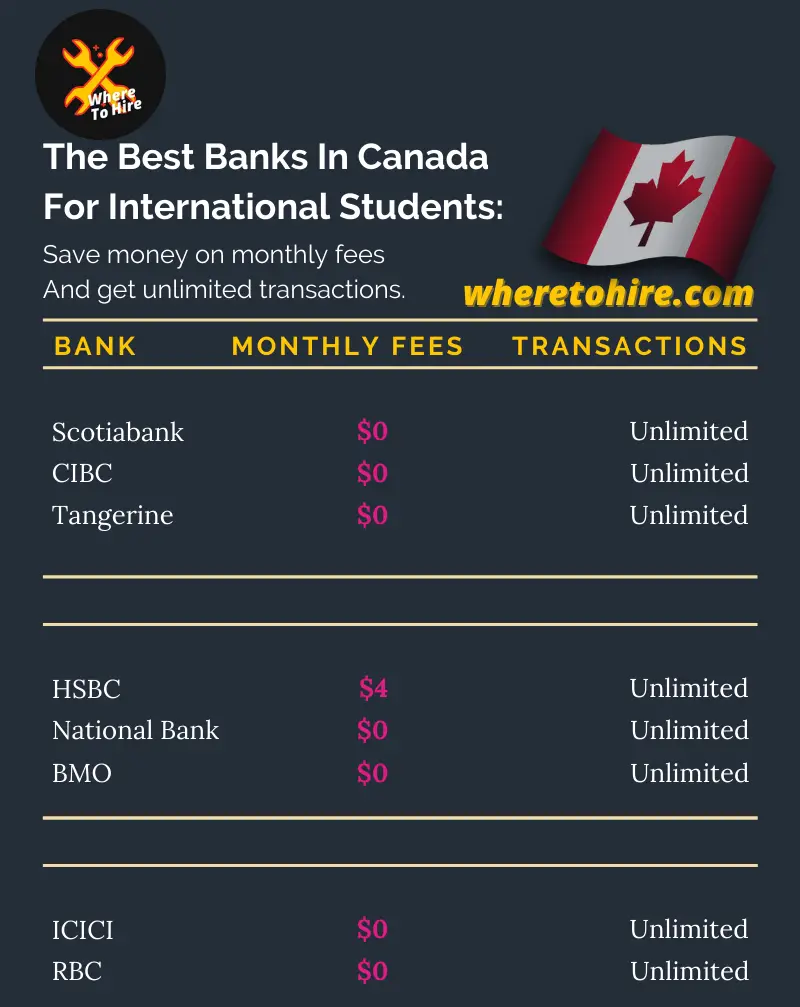

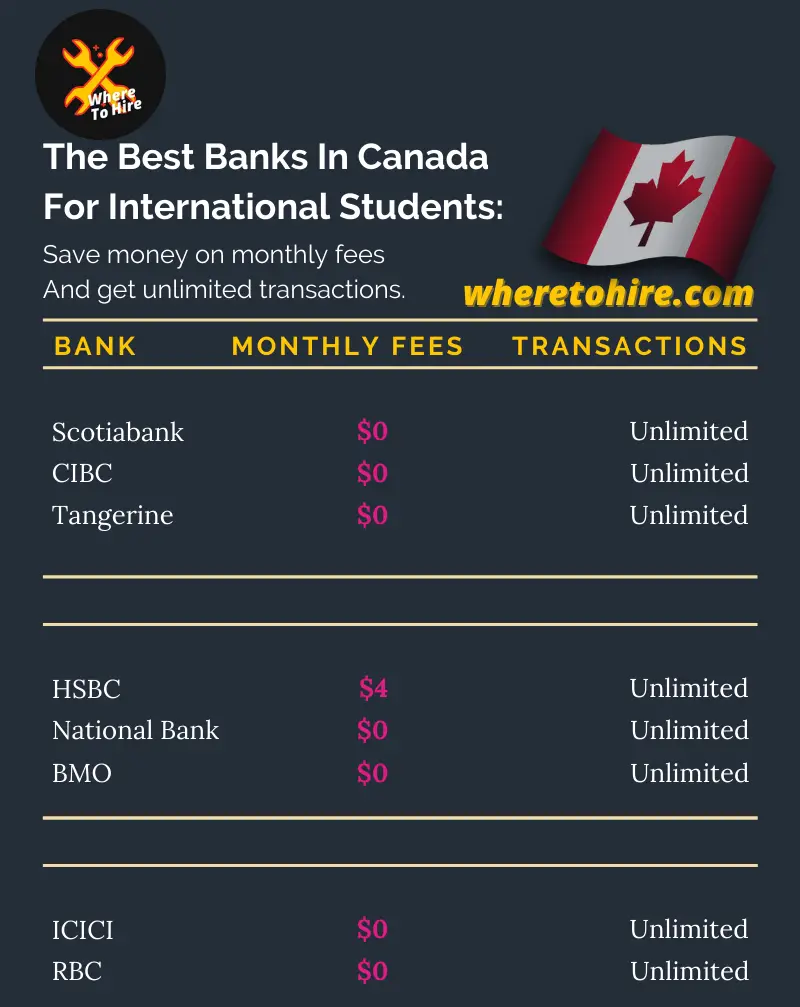

Best Banks For International Students In Canada 2021

What are the best banks for international students in Canada?

Studying abroad means a new way of living, especially in financial terms, since you'll need to adapt to a different currency.

That's why we'll reveal you what banks are the most student friendly, in terms of affordability, safety, number of transactions allowed and accessibility.

Top best banks in Canada for international students you should consider

1. Scotiabank Student Advantage Plan

Scotiabank Canada is well known internationally.

Its StarRight program allows international students to send or receive money internationally or electronically by $0 fees, which makes it one of the best canadian banks for newcomers.

To consider:

Especially if you're from a country such as China, India, Vietnam or Philipines, you'll have access to the Scotiabank Student GIC Program, which allows you to get your student permit faster.

- $0 Monthly fees.

- $0 Hidden fees.

- 900 branches spread out in Canada.

- Online banking.

- Online customer support available

- Limited eligibility for foreign students to access the Scotiabank Student GIC Program.

2. CIBC

Leverage Interac e-Transfer service, transfer money internationally and perform transactions unlimitedly by $0 fee, with the CIBC Smart Students plan.

What you'll need to be eligible:

Simply prove to them that you have an international student status.

As an international students you'll be able to manage your finances through the CIBC Mobile Banking App, which has been rated with the highest score for mobile banking according to J.D. Power as of 2021.

- No monthly fees.

- Credit cards option for student with $0 monthly fees, to start your credit history.

- Access to 4,000 ATMs and 1,000 branches across Canada.

- Customer service available 24/7.

- CIBC Mobile App only available in english and french.

3. Tangerine

Tangerine offers you a no-fee daily chequing account.

It includes Interact e-Transfer service for free, unlimited transactions and free access up to 3,500 automatic banking machines(ABMs) through the Scotiabank ABM Network, so you can deposit or withdraw money as much as you need.

In terms of customer care, Tangerine celebrated the 10th year by winning in customer satisfaction according to J.D. Power, as of May, 11, 2021.

To keep in mind:

A 2.50% will be added when converting a foreign currency at the moment you want to receive money.

- Free checking account for everyone(Foreign students too).

- No monthly fees.

- Unlimited monthly transactions.

- Not available branches.

- Permanent residence is necessary for elibility on credit cards

4. HSBC International Student Program(SDS)

HSBC has an outstanding benefit in terms of bonus.

HSBC offers its Newcomers Student program which allows yo to get access to several bonus options that range from $50 up to $100.

Just by joining them you can access to $50 in your initial bonus and $0 banking fees for chequing accounts.

As a newcomer student, you'll have access to unlimited debit transactions.

It offers you different perks based on your field of study, which could be useful to save up to $867.

If you open an account under a promotion there will be no monthly fee for first 12 months on international transfer and then you will be charged $4 per month.

The outstanding perk:

No credit history is needed so you can get a credit card that allows you to reach up to $1,000 dollars in your credit limit and over 3,300 ATMs across Canada.

You can meet faster your immigration requirements to meet your study goals in Canada, in the event you are from China, India or Vietnam.

- No monthly fees for a year under promotion.

- No minimum balance requirements.

- Free Interac e-Transfer service.

- Free ATM withdrawals.

- Online/mobile banking easy to use.

- Application fees may apply when opening an account.

5. National Bank

Prepare your financial management in Canada, by signing up online with National Bank.

The difference with this institution is that while many other banks ask an age of at least 18 years old, you can become into a new account holder starting at 17 years old.

- $0 monthly fees for the first 3 years.

- Custom mastercard options based on your needs.

- Unlimited online transactions.

- You'll have to pay monthly fees after three years, so it couldn't be the best choice if your study program last over 3 years.

- International transfer service not available for latin american countries.

6. BMO

This canadian international student bank account is better for students coming from China, since it'll help them to get student permit easily.

Foreign students from China will be able to open an account via internet to send up to $75,000 CAD before moving to canadian territory.

You can also access to student credit cards with $0 monthly fees, through visiting a BMO branch.

In terms of international money transfers, you can use its wire payment service or the Western Union option through BMO online banking to send money to more than 200 countries.

- $0 monthly fee on savings and chequing accounts.

- You'll be paid 100% by any losses as a result of unauthorized transactions.

- Unlimited transactions.

- Unlimited Interact e-Transfer for free.

- Over 900 branches across Canada.

- Benefits to speed up the student immigration requirements don't apply if you're not from China.

7. ICICI Bank

ICICI offers its Hello Bank Account for international students coming from the following countries:

- Vietnam.

- USA.

- UK.

- South Africa.

- Singapore.

- Philippines.

- China.

- Germany.

- Bahrain.

- India.

With over 3,600 ABMs spread out in Canada, a no monthly fees chequing account and a first year rebate credit card, you can start to arrange your financial needs.

Unlike BMO or HSBC, ICICI offers a GIC Program for a wider international students audience.

Turns out that the ICICI's Student GIC Program is focused on students from China, India, Philippines, Vietnam, Morocco and Senegal to ease the student permit.

- No monthly account fees in the 1st year with its HIVALUE Chequing Account.

- No fees on international transfers.

- Send money instantly to India.

- Interac e-Transfer to send money to Canada with no fees.

- Customer care availble 24/7.

- Minimum balance requierements of INR 5000($83.65 CAD).

8. RBC

This institution provides you with a free international transfer for a year, but with a limit up to 2 international transfer per month.

If you're looking for Interac e-Transfer service, this company provides you whit it too.

What about withdrawals? You can withdraw your money without additional RBC fees regardless of the bank's ATM.

It also offers a GIC Program, but focused on students from China and India.

When it comes to customer service, you'll get access to it in 200 different languages whether it be over the phone or in branch.

Consider this:

You'll have to pay $1.00 by any subsequent transaction over the limit of 999 Interact e-Transfer transaction in a month.

- If you're a full-time student there will not be monthly fees.

- Mobile banking with the RBC Mobile App.

- Unlimited transactions in Canada.

- No annual fee credit card to earn rewards.

- GIC program available for students from China or India.

Conclusion

As an international student, if you are planning to move to Canada, it'll be better if you choose a bank entity which provides you with no monthly fees, no transaction restrictions, including those international transfers.

In addition to the previous features we just pointed to, consider the advantage of the GIC program offered by the institution that better fits your needs, so you can make your life easier in terms of immigration and manager your banking life in Canada.

Best banks in Canada for international studentes FAQs

How can an international student open a bank account in canada?

- Social Insurance Number.

- Study permit.

- Passport.

What is the best bank for international students in Canada?

The best bank for international students in Canada is CIBC, since there's not monthly fee, unlimited transaction and has the highest rating in terms of mobile banking according to the J.D. Power's study as of 2021.