What Are The Best Credit Unions In California? | [Top 10 List]

Did you asked what are the best credit unions in California? Let's face it, as long as you want to finance a home, a car, or getting a credit card, maybe you already know that a financial cooperative is better than a big bank.

In fact, according to statista, there are 126 million members of credit unions in the U.S., $1.19 trillion granted and a growth of 5% in terms of loans, while the savings rate by U.S credit unions raised a 20.6%.

That said, while there are 141 credit unions in California dedicated to their communities, we want to show you a list of the best options in this state, in terms of their services, locations and rates.

The top credit unions in California

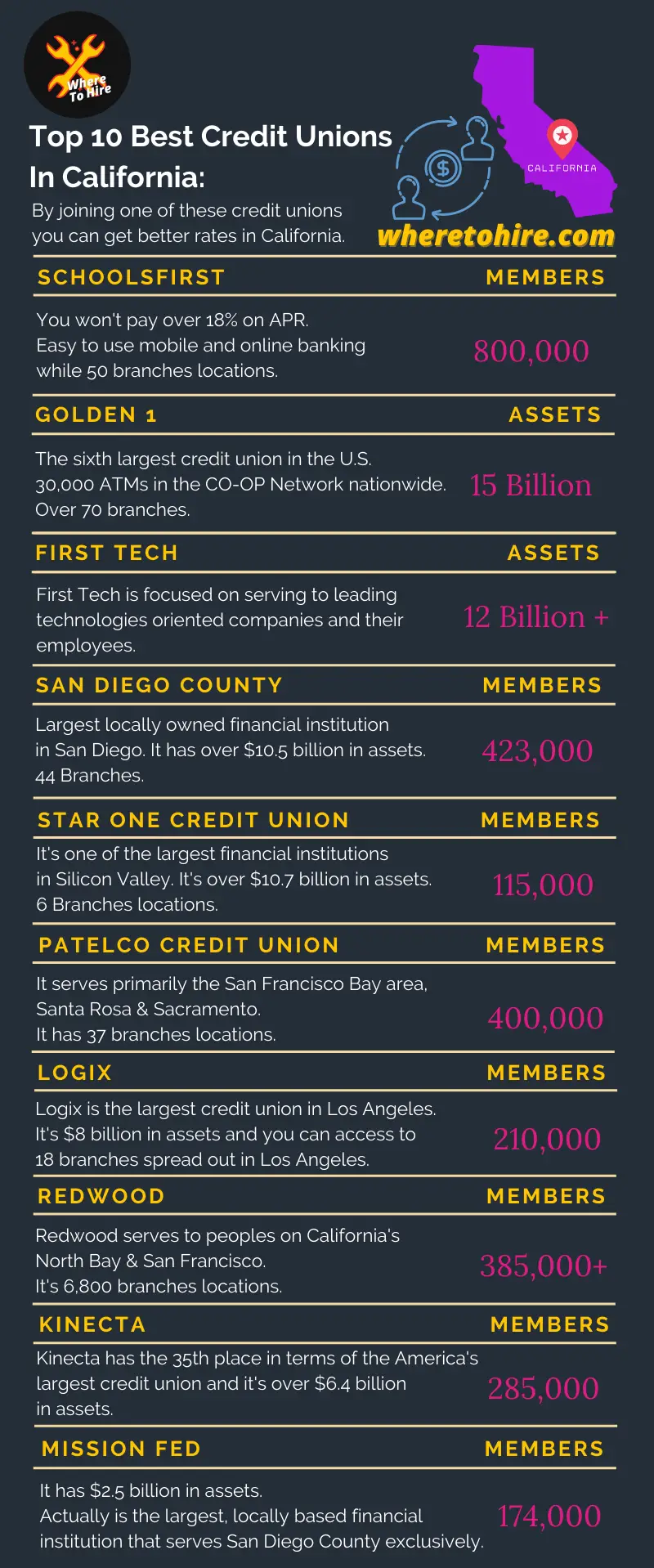

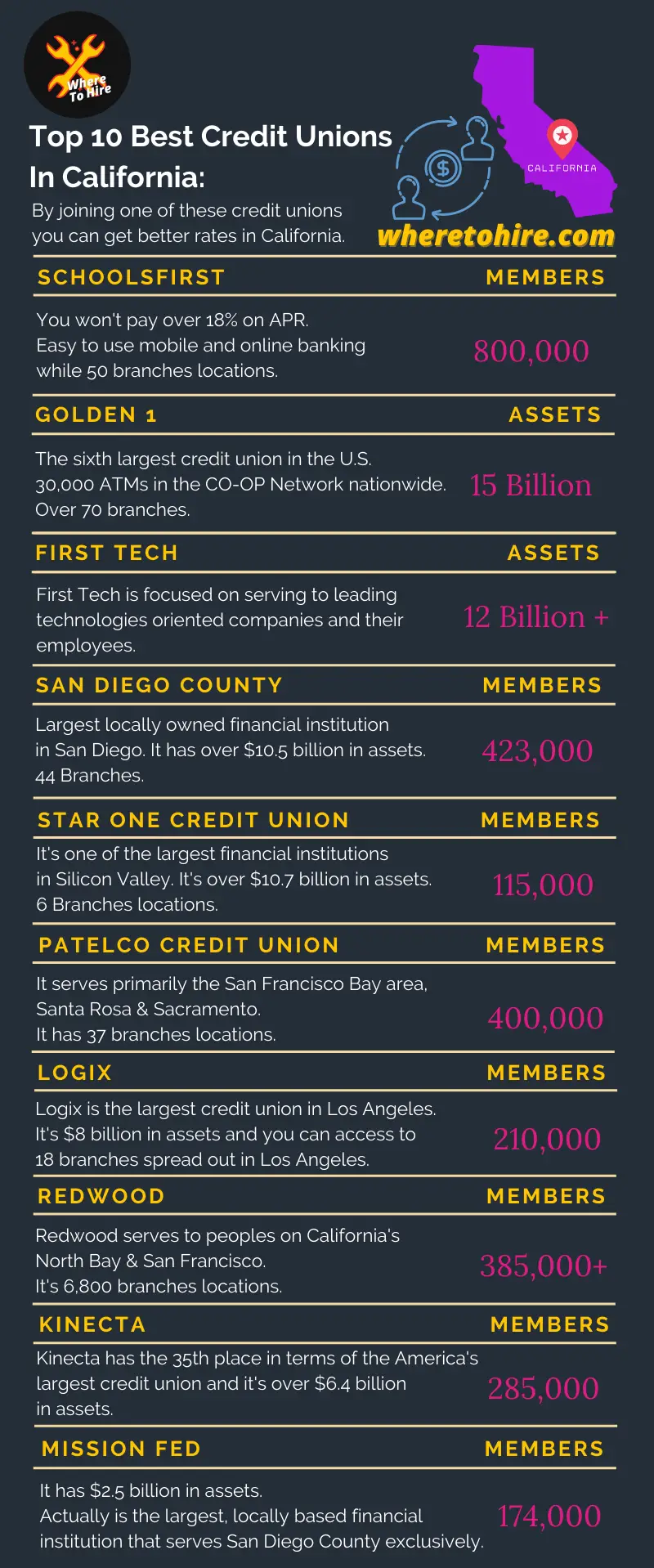

1. SchoolsFirst Federal Credit Union

SchoolsFirst FCU started with schools employees who used to make deposits and got loan benefits in Orange County.

Today it supports over 800,000 members, keeping in mind that its target audience is limited to school employees.

It provides you with low rates, since they promise you won't pay over 18% on APR.

Even their members save up to $1,923 a year, when using their services such as mortgage or auto loans, and credit cards.

In 2019, this organization donated $2.5 million, supporting to school employees, school programs and students.

- Mobile and online banking available 24/7.

- ATMs: 28,000 in the CO-OP Network nationwide.

- Minimun balance: $5 in your share savings account.

- Branches: 50.

If you are a foreign, keep in mind that there will be a fee of 2% by the amount of the transaction.

2. The Golden 1 Credit Union

Golden 1 is California’s leading financial cooperative and the sixth largest credit union in the U.S.

It has over $15 billion in total assets and offers products such as personal, auto and home loans.

Since 1993 it's serving their members and you can open easily your online account.

- Mobile and online banking available 24/7.

- ATMs: 30,000 in the CO-OP Network nationwide.

- Branches: Over 70.

3. First Technology Federal Credit Union

First Tech focus on serving to leading technologies oriented companies and their employees.

Yo can get an APR of 6.99% in credit cards. If you need savings and checking accounts or certificates, then you will access to an APY of up to 0.50%.

It also offers a 4.00% in terms of APR for home equity, while a 2.55% APR for student loans refinance.

- 10 Locations in California and more than 40 locations spread out in 8 states.

- Online and mobile banking.

- 30,000 surcharge-free ATMs nationwide.

- Access to more than 5,600 CO-OP branches across the U.S.

4. San Diego County Credit Union

Largest locally owned financial institution in San Diego, it started with the purpose to solve the financial needs of government employees in the local county.

Serving over 423,000 members, this financial institution has over $10.5 billion in assets.

You can find with San Diego County Credit Union APR of 1.99% for auto loans, APR of 2.408% for home loans, credit cards with an APR of 9.99%, while a high APY of 1.15% in certificates.

- Branches: 44 Branch locations.

- Mobile and online banking.

- Over 30,000 surcharge-free ATMs nationwide.

5. Star One Credit Union

Star One is one of the largest financial institutions in Silicon Valley, which serves more than 115,000 members worldwide, and owns over $10.7 billion in assets.

This credit union in California offers car loans with a low APR of 2.29%, while in terms of checking and savings accounts you can access to an APY of 0.50%.

Another of their featured products are the mortage loans without origination fees.

There are two options available which are the 30-year fixed Jumbo mortage with an APR of 3.027% and the 15-year fixed Jumbo mortage with an APR of 2.416%.

- Branches: 6.

- ATMS: Nearly 30,000.

- Deposit checks at surcharge-free CO-OP ATMs.

- Mobile and online banking.

6. Patelco Credit Union

Patelco serves primarily the San Francisco Bay area, Santa Rosa & Sacramento, having over 400,000 members.

In terms of APY it offers 1.00% for savings accounts which holds up to $2,000, while it provides an starting APR of 5.70% for personal loans, and an APR as low as 6.20% for credit cards.

For home equity line of credit it offers a variable rate starting at 3.750% in APR and a fixed rate as low as 3.924%.

- Branches: 37.

- ATMS: 30,000 charge-free ATMs nationwide.

- Mobile and online banking.

7. Logix Federal Credit Union

Logix is the largest credit union in Los Angeles, with over 210,000 members and $8 billion in assets.

It has new auto loan rates as low as 1.24% APR, while for used cars the rates are as low as 1.49% APR for 36 months.

You can even access to a free debit card to earn rewards and free box of checks.

- Branches: 18 in los Angeles and Ventura counties.

- ATMS: 30,000 charge-free ATMs across the U.S.

- Mobile and online banking.

8. Redwood Credit Union

Redwood serves to peoples on California's North Bay & San Francisco and has more than 385,000 members.

This institution offers new/used auto loan as low as 2.29 % APR, while 5/5 arm mortgage loan as low as 3.199 % APR and a rate of 2.500%.

In the event you need a credit car, you can get the your Visa Platinum credit card with an APR as low as 8.99%.

- Branches: 6,800 locations.

- ATMs: 30,000 CO-OP ATMs.

- Mobile app and online banking.

9. Kinecta Federal Credit Union

Kinecta has the 35th place in terms of the America's largest credit union. While serving over 285,000 members, this financial institution has over $6.4 billion in assets.

This financial entity offers a divident rate of 0.50% and APY of 0.50%.

When it comes to credit cards, the APR range offered by Kinetica is 7.99% - 18.00%.

It also provides an APR of 7.74% for personal loan, while 2.74% APR for new auto loan and 2.84% APR for used auto.

- Branches: 5,821 Shared credit unions branches.

- ATMs: 30,000 surcharge-free ATMs.

- Mobile and online banking.

10. Mission Federal Credit Union San Diego

Mission Fed serves 174,000 members and has $2.5 billion in assets.

Actually is the largest, locally based financial institution that serves San Diego County exclusively.

For car loans their APRs vary from 1.79% to 4.39%.

If you need a recreational vehicle loan, you can find APRs from 4.49% to 5.49%.

You'll also find with Mission Fed options for credit cards, which APR vary from 9.90% to 17.90%.

- Branches: 33 locations.

- ATMs: 30,000 fee-free CO-OP ATMs across the U.S.

- Mobile and online banking.

Conclusion

When it comes to the top California credit unions, it will be better that you choose those that provide you with all the necessaries branch and ATMs locations, low rates and an easy to use banking platform to manage your financial needs.

Best credit unions in California FAQs

What are the best credit unions in Orange County California?

Kinecta and SchoolsFirst are the best credit unions in orange county California.