Best Credit Unions In Colorado 2021 To Get Better APR & APY

What are the best credit unions in Colorado? Whether you live in Denver, CO or any other place inside the Colorado state, perhaps you need a financially strong ally.

Throughout this post you'll see a list of credit unions in Colorado with the highest assets and members.

The largest credit unions in Colorado 2021 | [Top 10 list]

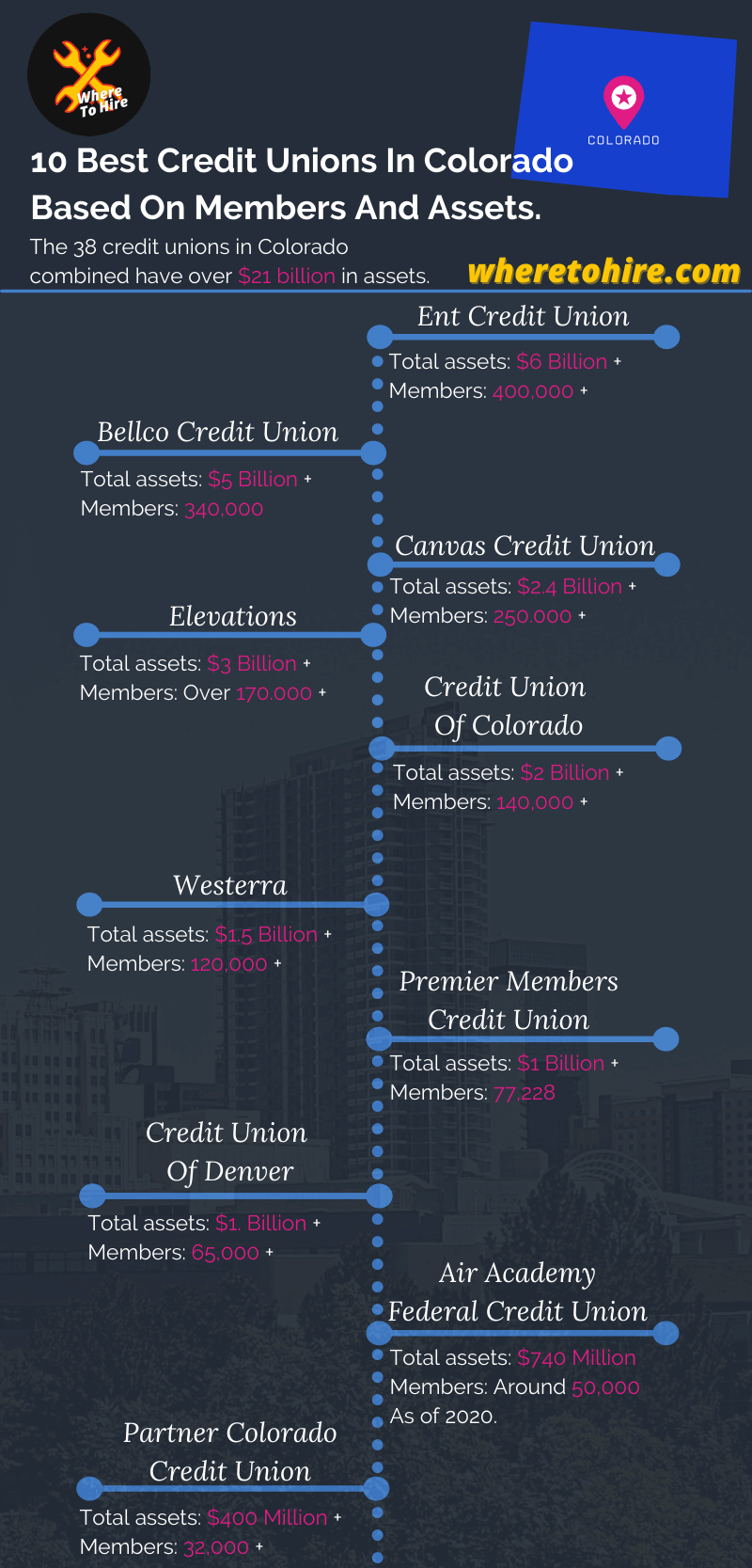

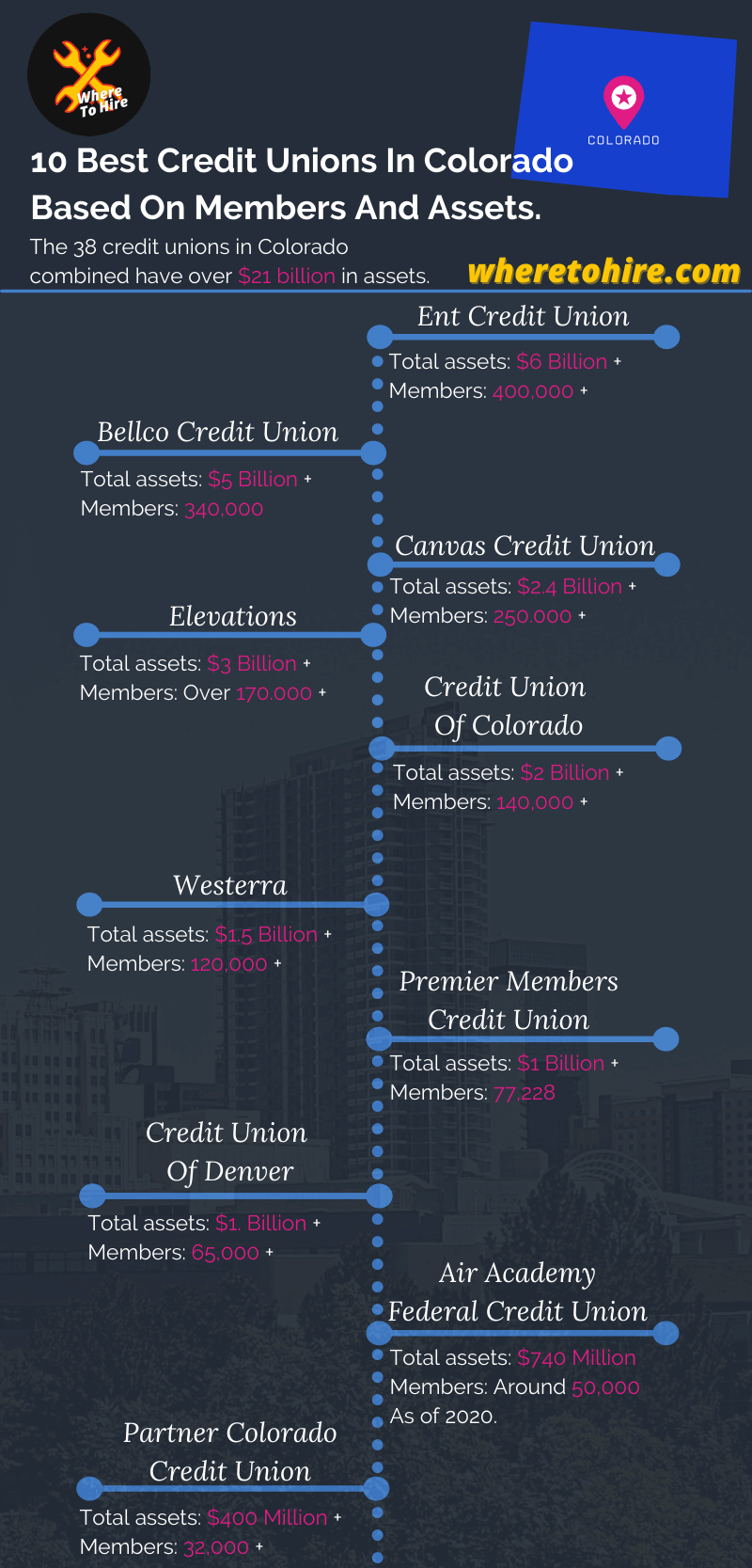

While the 38 credit unions that exist in Colorado combined have over $21 billion in assets, we'll show you those that are financially strongest and provide you personalized service.

1. Ent Credit Union

Since 1957 Ent was established initially to solve financial needs to the Ent Air Force Base and today has over $6 billion in assets and it's awarded as the best credit union in Colorado Springs, CO.

It serves to over 400,000 members and owns 46 service centers. Central offices are located in Colorado Springs.

As long as you need an ATM, with this cooperative you'll be able to access to 30,000 ATMs nationwide.

Its rates:

- Auto: 3.490% - 11.340% APR.

- Home equity: 3.250% - 6.490 APR.

- Personal: 5.990% - 17.240% APR.

- Mortgage purchase: 2.187% - 3.038% APR for fixed.

- Mortage refinance: 2.187% - 2.912% APR for fixed.

2. Bellco

It was established in 1936, but today is one of the largest credit unions in Colorado with over $5 billion in assets and 340,000 members.

The central offices of this credit union are located in Centennial, Colorado.

Members have access to 26 branch locations spread out from the Front Range to the Western Slope and surcharge-free ATMs across the U.S.

Its rates:

- Checking: 2.25% APY for balance ranging $0 - $25,000.

- Auto: As low as 2.49% APR.

- Loans: 2.50 APR for shared secured - fixed.

- Credit cards: 0% intro APR, but later could start ranging 11.50% - 21% APR for Visa ® Colorado Rewards Credit Card, while 9.50% - 21% APR for Visa ® Platinum Credit Card.

- CD: APY as high up to 0.65%.

- IRAs and savings: APY as high up to 0.40%

3. Canvas Credit Union

Operating since 1938, has over $2.4 billion in assets and more than 250,000 members.

It provides members with 30 branch locations and over 200 shared branches in Colorado, while over 30,000 surcharge-free ATMs.

Its rates:

- Savings: Up to 2.50% APY.

- CD: Up to 0.80% APY.

- Checking: Up to 0.15% APY for more than $25,000 in balance.

- IRAs: Up to 0.90% APY.

- Money market: Up to 0.45% APY.

- Vehicles: As low as 2.99% APR.

- Personal loans: As low as 9.99% APR.

- Credit cards: As low as 6.99% APR.

4. Elevations Credit Union

Elevations was established in 1953, today it's over $3 billion in assets and serves more than 170,000 members.

It was rated as the number 1 credit union mortgage lender in Colorado in 2018 by Scotsman Guide.

This non-for-profit financial institution has 15 branch locations in Colorado, while over 5,000 shared branches nationwide.

Its rates:

- Mortgage: Offers down payments as low as 3%.

- Savings: As high as 0.15% APY.

- Money market: Up to 40% APY.

- Checking: Up to 0.25% APY.

- Certificates: Up to 0.50% APY for Jumbo certificates.

5. Credit Union Of Colorado

CUofCO was established in 1934, it serves more than 140,000 members, has over $2 billion in assets.

While central offices are located in Denver, CO, Members will have access to 17 branch locations spread out in the Colorado area.

This non-for-profit financial entity is partnered with the CO-OP network, and members have access to 62,000 ATMs nationwide.

Its rates:

- Auto: As low as 2.49 APR.

- Home equity: 3.50% APR.

- Credit cards: 6.25% APR.

6. Westerra Credit Union

Founded in 1934, today it's over $1.5 billion in assets and over 120,000 members.

If you live in the 7-county Denver metro area, you can join them. It's available 10 branches, while 200 CO-OP shared branches in Colorado.

Its rates:

- Home purchase loans: 2.750%/ 2.782% APR for 30 years fixed.

- Mortgage refinance: 2.875%/2.906% APR for 30 years fixed.

- Certificates of deposit: Up to 0.70% APY.

- IRAs: Up to 0.70% APY.

- Auto: As low as 3.24% APR.

- Credit cards: Ranging 7.90% - 21% APR for Visa Select Balance Transfer credit card after the 1.99% intro APR.

7. Premier Members Credit Union

Premier Members Credit Union is the 7th largest credit union in Colorado with over $1 billion in assets and 77,228 members as of 2020.

It has 15 branch locations in Colorado and it's partnered with the CO-OP ATM network. If it's not enough, members also can access over 5,600 shared branch locations across the U.S.

- Auto loan: 2.89% APR.

- Home equity loans: 3.75% APR.

- Checking: Up to 1.00% APY.

8. Credit Union Of Denver

It was established in 1931 in Denver, Colorado, today has over 65,000 members and over $1 billion in assets.

This non-for-profit cooperative offers more than 30,000 ATMs surcharge-free ATMs nationwide and over 5,600 shared branches nationwide.

- Auto: As low as 2.44% APR.

- Mastercard Platinum: As low as 7.24% APR.

- HELOC: As low as 3.99% APR.

- IRA certificate: As high as 0.70 APY.

- Certificate Special: As high as 0.70 APY.

9. Air Academy Federal Credit Union

This financial entity was born in 1955 to supply the financial needs of military and civilian members belonging to the Air Force Academy.

By the end of 2020, this institution reached the amount of $740 million in assets and about 50,000 members.

While its central offices are in Colorado Springs, it's 8 branches locations, offers 5,600 shared branches and about 30,000 surcharge-free ATMs.

- Auto: As low as 3.39% APR.

- Home equity: As low as 3.00% APR.

- Mortgages: As low as 2.49% APR for 15 year fixed.

- Cash rewarding checking: As high as 1.25% APY.

- Personal loan: As low a 7.89% APR.

10. Partner Colorado Credit Union

It started in 1931, but now it serves over 32,000 members and owns over 400 million in total assets.

This financial entity has 6 branches in Denver, offers several CO-OP shared branches across the U.S.

Its rates:

- Auto: As low as 3.14% APR.

- Signature loan: 9.99% APR.

- Credit cards: 9.74% variable APR.

- Savings securde loan: 3.00% variable APR.

- Checking overdraft line of credit: 18.00% APR fixed.

- HELOC fixed rate: As low as 5.00% APR.

- HELOC variable rate: As low as 3.75% APR.

- IRAs savings: As high as 0.20% APY.

Conclusion

If you're living in Denver or Colorado Springs, you should be consider one of these non-for-profit organizations to save more in APR as long as you need any kind of loan.

Best credit unions in Colorado FAQs

What are the best credit unions in Colorado Springs?

Ent is the best credit union in Colorado Springs according to Forbes.