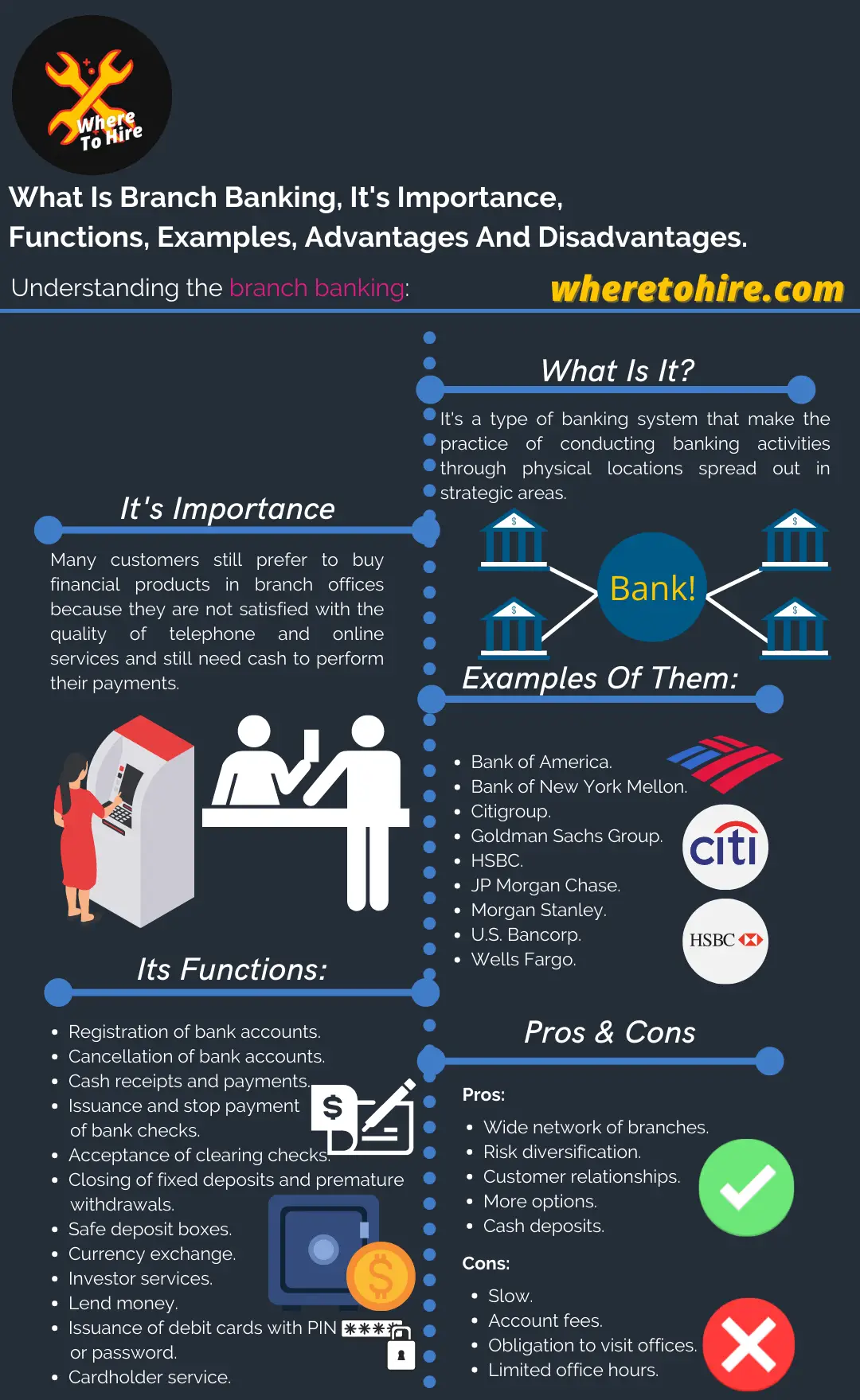

The Advantages And Disadvantages Of Branch Banking

What is branch banking, their functions, advantages and disadvantages for customers? Let's start by understanding the branch banking meaning:

Branch banking is a type of banking system that make the practice of conducting banking activities through physical locations spread out in strategic areas. Many large and small banks use branch banking system to extend the reach of their services to different locations in a community, state or country.

A bank branch is the channel where you can carry out a 100% of your banking activities and based on the size of the bank you can find a branch in different locations.

What are the advantages of branch banking to customers?

1. Wide network of branches

Biggest banks in United States have physical locations and ATMs, which are free of charge to customers, throughout the country.

2. Risk diversification

In the event something harmful happens in a branch, it doesn't necessarily affect the operations of another branch locations.

3. Customer relationships

Traditional banks can still leverage the convenience of in-person touch points at branch locations to solidify customer relationships

4. More options

Whether you want a personal checking or savings account, a trust fund, a certificate of deposit, a voluntary pension account, or a business checking account, most financial institutions can provide all of these services in one place.

Many traditional banks also offer investment and wealth management services.

5. Cash deposits

Despite all the progress that financial technology has made, the industry still has to deal with a traditional form of currency which is the cash. For bank customers who handle cash frequently, a traditional bank is an attractive and convenient option.

What are the disadvantages of branch banking?

1. Slow

A major disadvantage of traditional banking continues to be the slowness with which many staff members operate when providing customer service, since human resources are always required to process transactions.

2. Account fees

Maintaining a current account generates the payment of fees for its maintenance and also for transactions such as withdrawals or transfers.

3. The obligation to visit the offices

When it comes to making a transfer or any other type of financial transaction, you will have to go to the offices, which are not always close to your home or office, during established business hours.

4. Limited office hours

Similar to the above point, branch locations of a bank has limited office hours.

What are the functions of branch banking?

- Registration of bank accounts.

- Cancellation of bank accounts.

- Cash receipts and payments.

- Issuance and stop payment of bank checks.

- Acceptance of clearing checks.

- Closing of fixed deposits and premature withdrawals.

- Safe deposit boxes.

- Currency exchange.

- Investor services.

- Lend money.

- Issuance of debit cards with PIN or password.

- Cardholder service.

What is the importance of branch banking?

Many customers still prefer to buy financial products in branch offices because they are not satisfied with the quality of telephone and online services.

In terms of making payments, many consumers still need cash to perform their payments and a branch location is where people will need to withdraw the cash.

Rural business owners may also have more limited access to online banking services, making a bank branch essential to the operation of their business.

Example of branch banking

Some examples of branch banks include:

- Bank of America.

- Bank of New York Mellon.

- Citigroup.

- Goldman Sachs Group.

- HSBC North America Holdings.

- JP Morgan Chase & Co.

- Morgan Stanley.

- U.S. Bancorp.

- Wells Fargo & Company.

Unit banking vs branch banking

Unit banking refers to a bank that is a single bank, is usually not large in size, and provides financial services to a group of people in a small locality. A unitary bank operates independently and does not have branches in other locations.

Branch banking refers to a banking entity controlled by a larger financial institution and unlike unitary banks, it has several branches that are spread across different geographic locations to provide access to the greatest number of customers.

Conclusion

Even when there are newer ways of bank operations, so many people prefer visiting a convenient branch location to access their financial services with a bank.

Branch banking FAQs

Why is branch banking important?

Many customers still prefer to buy financial products in branch offices because they are not satisfied with the quality of telephone and online services. They also can access to all the financial services in one place, such as cash withdrawal and deposits.