The 10 Best Credit Unions In Texas

What are the best credit unions in Texas? It's a fact. Many people say that even some of the best banks in United States use to charge high fees and won't necessarily provide the best customer experience.

But not all is lost, since there are 203 financial cooperatives in Texas.

Throughout this post we'll show you a list of the 10 best credit unions in Texas so you can get the best rates.

The best credit unions in Texas so you can get the best rates

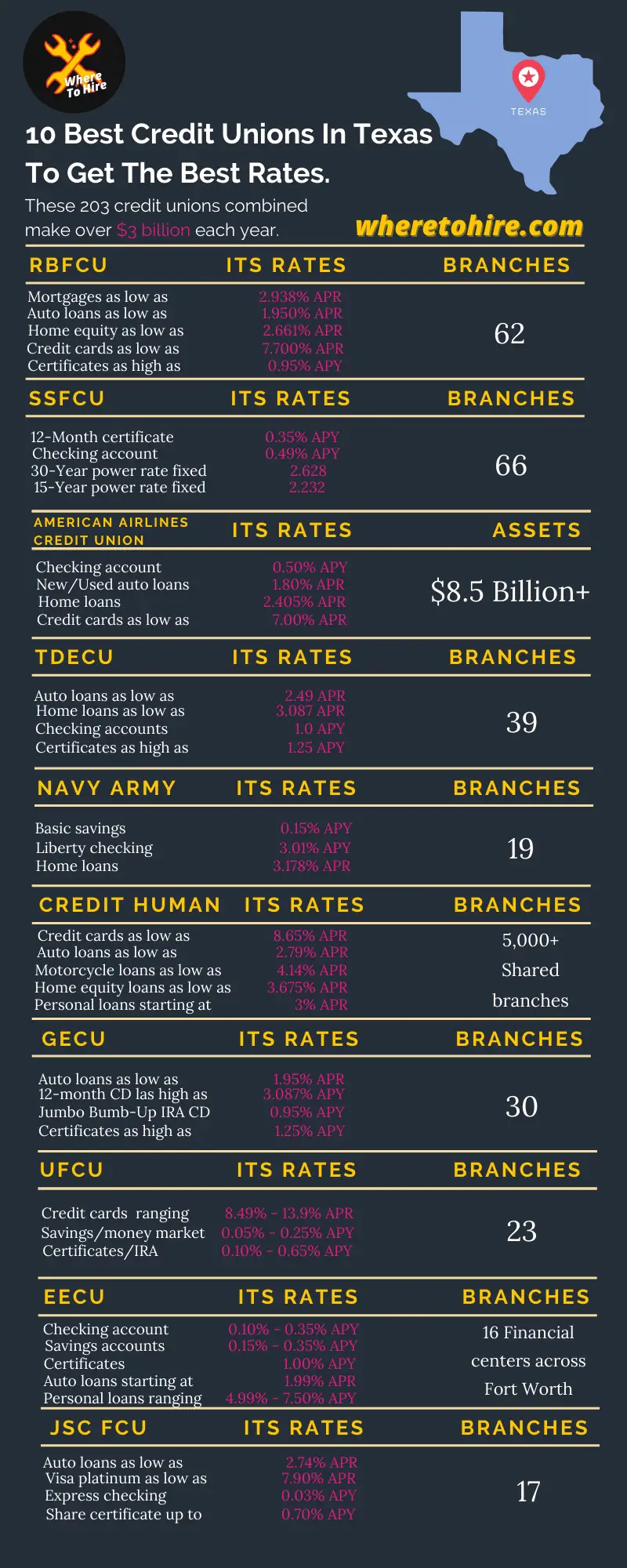

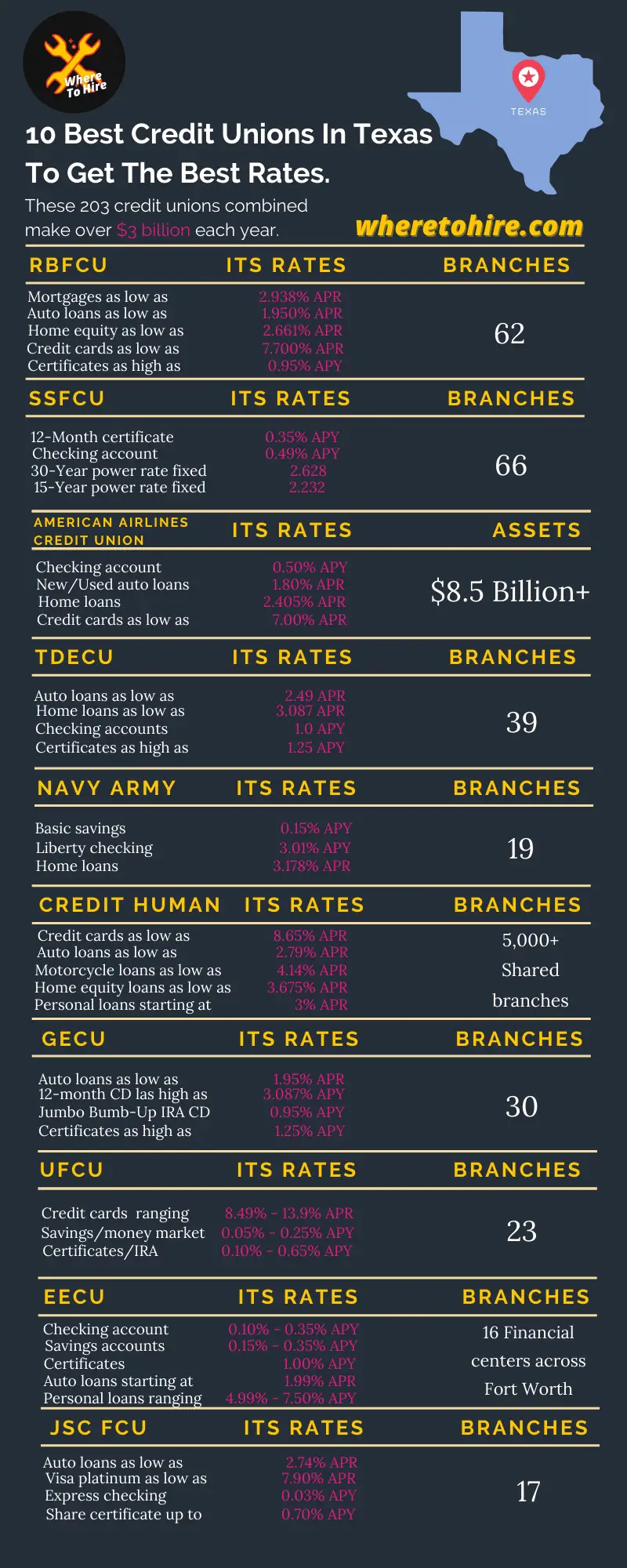

As a quick note, according to Cause IQ, all of the texans credit unions combined, make over $3 billion in revenue each year, but with the benefit that a credit union is community focused and a not-for-profit organization. Let's start!

1. Randolph-Brooks Federal Credit Union

RBFCU has evolved from being a financial resources provider for military service members and their families to serving hundreds of thousands of members across Texas and worldwide.

It's a trusted partner for thousands of member in Texas and its majority of market is based on areas such as Dallas-Fort Worth, San Antonio, Austin and Corpus Christi.

While it's 62 branches, ATM users have surcharge-free access to any of the CO-OP Network ATMs available in its map.

Its rates:

- Mortgages as low as 2.938 APR.

- Auto loans as low as 1.950 APR.

- Home equity as low as 2.661 APR.

- Credit cards as low as 7.700 APR.

- Certificates as high as 0.95 APY.

2. Security Service Federal Credit Union

It's born as the United States Air Force Security Service Federal Credit Union (USAFSSFCU), but opened its doors at Kelly Air Force Base in San Antonio, Texas with only eight members and $25 in deposits.

Today this financial cooperative has over $9.5 Billion in assets, over 770K members, over 30,000 ATMs in the network and 66 branches. In addition you can enroll easily to its online banking service.

Its rates:

- 12 Month certificate with 0.35% on APY.

- Earn up to 0.49% in APY on checking account with a balance over $250,000.

- Get fixed power rate rates for 30 years as low as 2.628% and 2.232% for 15 years.

3. American Airlines Federal Credit Union

It's been established in 1936 by a little group of American Airlines employees, but now it's net worth well over $761.1 million and over $8.5 billion in assets.

Members belonging to American Airlines Federal Credit Union will have access to branches in most of the biggest U.S. airports and an extensive ATMs network, since this financial cooperative is partnered with the CO-OP ATM network.

Its rates:

- Earn an APY as high as 0.50% for checking account, while an APY as high as 0.40% for share and IRA savings accounts.

If you need a regular share certificate you can get an APY as high as 0.80%. - Get a new/used auto loan with an APR as low as 1.80%, while an APR as low as 4.49% for RV auto loans.

- In terms of home loans, the APR are 2.405% for 15-year fixed and 3.032% for 30-year fixed respectively.

- APR for credit cars falls between 7.00% - 12.24%.

4. TDECU

TDECU was formed in 1955 and today it defines itself as the largest credit union in Houston, while the 4th largest credit union in Texas, but among the best credit unions in Dallas, TX, this is the winner.

TDECU members will have access over 55,000 surcharge-free ATMs across the world.

Whether you live and work in areas such as the Greater Houston, Dallas-Fort Worth, Victoria and the Gulf Coast, you'll be eligible to open your account online to join this cooperative.

Its rates:

- Auto loans APR as low as 2.49%.

- Home loans APR as low as 3.087%.

- Checking accounts APY up to 1.00%.

- Certificates of deposit APY up to 1.25%.

5. Navy Army Community Credit Union

NavyArmy has been serving South Texas for 65 years. With 19 locations spread out the U.S., this financial cooperative owns 195,000 military and non-military members and has provided over $1 billion in loans by the 2020.

While you don't necessarily need to be a military member to join NavyArmy, you'll need at least to live, work, study or worship in one of the following South Texas counties:

- Aransas.

- Bee.

- Cameron.

- Hidalgo.

- Jim Wells.

- Kleberg.

- Nueces.

- San Patricio.

You can get with this financial provider the followings rates:

- Basic savings account with an APY of 0.15%.

- Liberty checking account which offers a high APY of up to 3.01%.

- Offers home loans with an APR as low as 3.178%.

6. Credit Human Federal Credit Union

Credit Human has been serving their members for over 85 years.

Once you become a memeber of this cooperative, you'll be able to carry out transactions through over 5,000 shared credit union branches across the U.S.

The drawback:

Unlike others financial cooperatives mentioned in this post, this cooperative is not partnered with the CO-OP network, so you'd be charged by the ATM owner in the event you carry out any transaction on this network.

Its rates:

- 3 Options available for credit cards, 2 of them with APR as low as 8.65% and one of 9.65%.

- New or used automobile loan with APR ranging from 2.79% to 2.89%.

- New or used motorcycles loans with APR ranging from 4.14% to 11.24%.

- Home equity loans with APR ranging from 3.675% to 4.267%.

- Several personal loans products with APR ranging from 3% up to 28.00%.

7. GECU

If you're living in El Paso, Texas and you need to join the largest local financial cooperative, then GECU should be your choice.

It's over 88 years helping people in the community, today more than 400k members belong to this cooperative which has reached over $3.5 billion in assets and owns 30 physical locations.

In terms of elegibility to join this cooperative, you'll need to live or work in counties such as El Paso, Hudspeth or Doña Ana of less than 25 miles from Resler and Helen of Troy Location.

Only $20 dollars is what you'll need to get your membership, in terms of opening your account, making the initial deposit and minimum share account balance.

You won't need to worry in terms of using your GECU debit card, since you'll have available thousands of surcharge-free ATMs in your local area or with thousands of ATMs across the U.S. since this cooperative is partnered with the CO-OP network.

Its rates:

- Auto loan rates in APR as low as 1.95% for 48 months.

- APY as high up to 0.25% in 12 month CD, while up to 70% for 36 month CD.

- Jumbo Bump-up IRA CD up to 0.95% in APY.

- APY up to 50% for money market savings account.

8. University Federal Credit Union

UFCU started in 1936 and over 200 universities, associations and employers located in Central Texas and Galveston County have selected this cooperative as one of their best allies.

UFCU has $7.522 billion in assets, while 336,707 members as of June 30, 2021 and in terms of the best credit unions in Austin, Texas, this one takes first place.

In terms of locations, it's 23 branches and as long as you are in the Central Texas and Galveston County, then you'll have free access to several ATMs.

So you be eligible to become a member of this financial ally, you'll need to belong to a company, school, association or having an immediate family member belonging to its membership field.

Keep in mind that if none of the conditions mentioned above matches your situation, then you'll have the alternative to join The University Of Texas Longhorn Fundation and then you'll become eligible.

Its rates:

- APR for credit cards from 8.49% - 13.9%.

- APY from 0.05% to 0.25% for savings and money market.

- APY from 0.10% to 0.65% for certificates and IRA.

9. EECU

It started as a credit union for teachers and administrators in Fort Worth in 1934.

Today EECU has over 2.9 billion in assets, offers an easy to use mobile and online banking.

You can access up to 5,000 service centers, 85,000 ATMs across the U.S, while 16 financial centers across the Fort Worth territory.

In terms of elegibility, you'll have to live, work, study, or worship in any of the following counties:

- Wise counties.

- Tarrant.

- Somervell.

- Rockwall.

- Parker.

- Palo Pinto.

- Johnson.

- Jack.

- Hood.

- Hill.

- Erath.

- Ellis.

- Denton.

- Dallas.

- Collin.

- Bosque.

If you're related to an EECU member or a select employers group, then you're eligible too.

Another option for eligibility would be that you are working for organization in the Fort Worth location, even if it's in the Young County.

Its rates:

- APY ranging 0.10% - 0.35% for checking account.

- APY ranging 0.15% - 0.35% on savings account, while 1.00% in APY for IRAs.

- APY of 1.00% for certificates.

- APR starting at 1.99% for auto loans.

- APR ranging 4.99% - 7.50% for personal loans. It also offers affordable loans for students who live in Texas.

10. JSC Federal Credit Union

JSC FCU is one of the largest credit unions in Houston, it started in more than 55 years ago and today has over 124,000 members across the Greater Houston Bay area.

By joining this financial entity you'll have access to 17 branch locations, while 27 JSC FCU ATM locations.

You can join this non-profit financial entity if you live, work, worship or study in any of the following locations:

- La Porte.

- Deer Park.

- Seabrook.

- Pearland.

- Pasadena.

- Dickinson.

- Galveston.

- Texas City.

- Friendswood.

- Ellington.

- League City.

- Houston (Clear Lake).

Its rates:

- Rate ranging 2.74% - 13.24% in APR for new/used cars loans.

- VISA Platinum credit card ranging 7.90% - 15.90% for APR.

- Express checking offers an APY of 0.03%.

- Share certificate ranging 0.20% - 0.70% for APY.

Conclusion

You've learned so far in this post a list of the best financial cooperatives in Texas.

However, keep in mind that the best option will depends based on your specific needs and location in the Texas area, since despite these financial entities use to provide better rates than traditional banks, maybe you'd need a financial cooperative with several service centers or branches.

Best credit unions in Texas FAQs

What is the best credit union in Austin, TX?

The best credit union in Austin, TX is University FCU, since it's $7.522 billion in assets, while 336,707 members as of June 30, 2021.