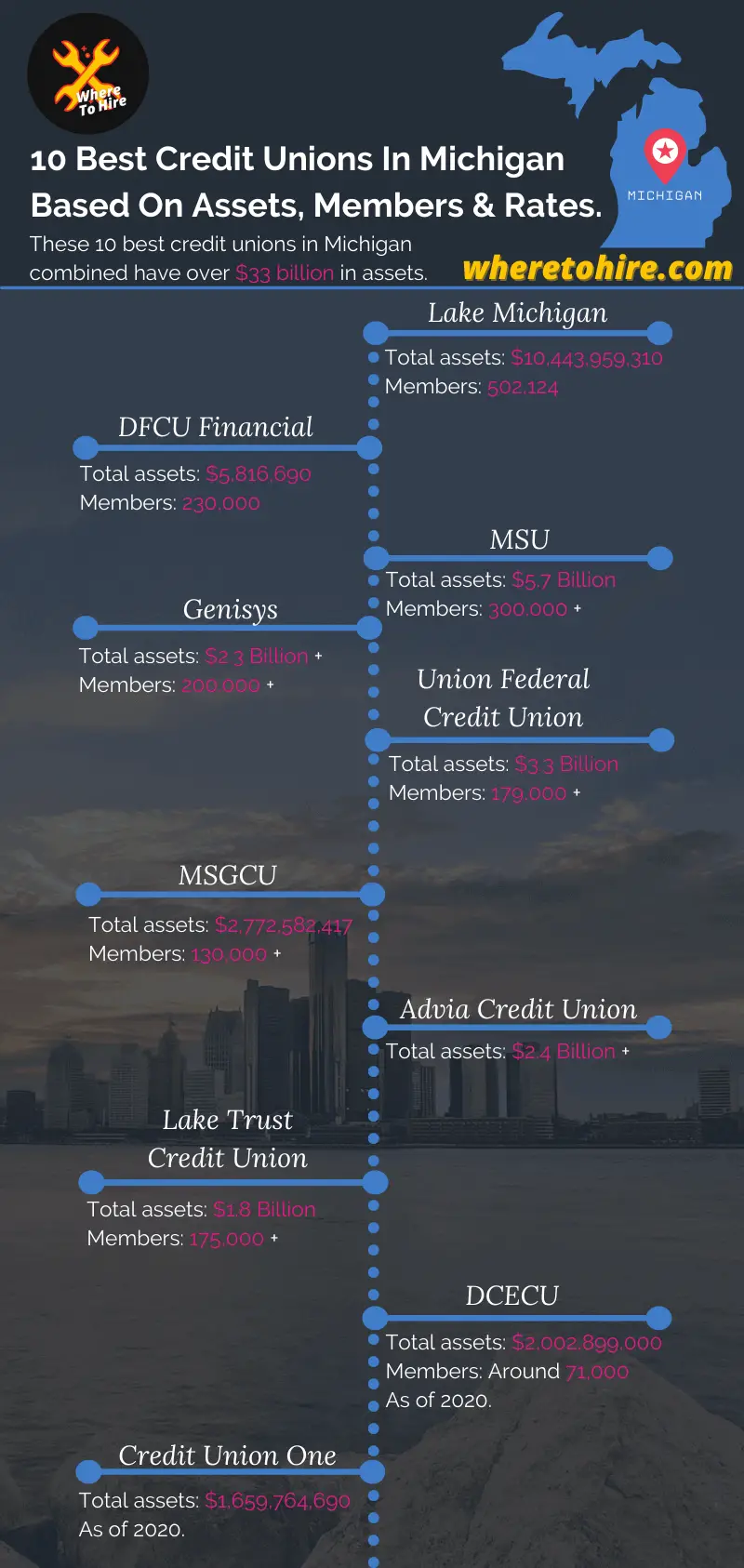

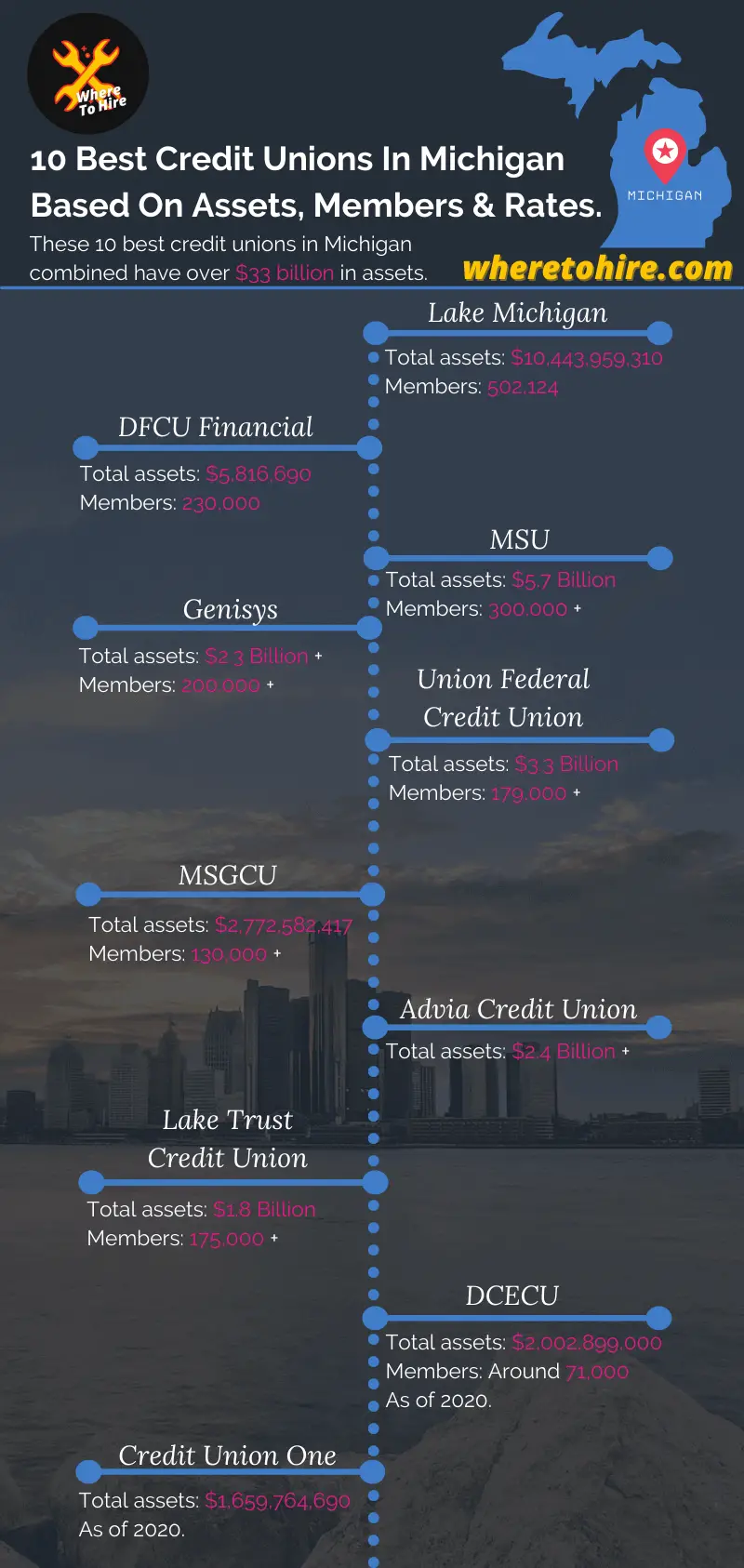

Best Credit Unions In Michigan 2021 Based On Assets & APR

What are the best credit unions in Michigan? As long as you are looking for a financial assistance that provides you unique value, you'd want the benefits of credit unions that better serve communities, instead of a bank making profit for itself.

While there are 218 credit unions in Michigan, throughout this post you'll learn about the 10 best in terms of assets, locations and rates.

See This List Of 10 Best Credit Unions In Michigan In Assets, Locations & Rates

1. Lake Michigan Credit Union

Established in 1933, headquartered in Gran Rapids, Michigan. It owns $10,443,959,310 in assets as of 6/30/2021, 502,124 members and 59 branch locations.

LMCU is one of the biggest credit unions in Michigan and membership is open to people in any county located in the Michigan's Lower Peninsula area or any county in the State Of Florida.

Its rates:

- New/used auto loans: As low as 1.99% APR.

- Credit cards: As low as 6.25% APR for Prime Platinum Visa Credit Card.

- Mortgage rates: 2.344% APR for 15 year fixed, while 2.946% APR for 30 year fixed rate.

- Home equity rate: 4.49% APR.

- HELOC: 3.00% APR.

2. DFCU Financial

DFCU Financial started in 1950, todays is one of the best credit unions in Metro Detroit, since it reached the amount of $5,816,690 in assets (As of 2020) and around 230,000 members.

It has 27 branches for its members spread out in Ann Arbor, Grand Rapids, Metro Detroit and Lansing.

You'll be eligible to join them as long as you study, work, live or worship in the Lower Peninsula.

Its rates:

- HELOC: APR starting at 4.00%.

- Closed End Home Equity: APR starting at 4.74%.

- Personal loan: APR starting at 15.24%

- Auto rates: APR starting at 2.74% for new auto, while starting at 2.99% for used cars.

- Boat loans: APR as low as 3.74% for a loan amount ranging from $5,000 to $35,000.

- RVs Loans: APR starting at 4.75%.

- Motorhome loans: APR starting at 4.00%.

3. MSU Federal Credit Union

MSUFCU was established in 1937 and headquartered in East Lansing, MI. Today is one of the top credit unions in Michigan, since it serves over 300,000 members and has $5.7 billion in assets.

It has 15 branches spread out in Mid-Michigan, West Michigan, Northern Michigan and Southeast Michigan.

This financial entity provides services mainly to the Michigan State University Community.

Membership is also open to people living, working, worshipping or business owners in counties such as Genesee, Lapeer, Livingston, Macomb and Oakland.

Its rates:

- Home loan: APR starting at 2.875%.

- Auto loan: APR starting at 1.99%.

- Cash Back Platinum Plus Visa: APR starting at 13.90%.

- Personal loan: APR starting at 5.90%.

4. Genisys Credit Union

Founded in 1936 and headquartered in Auburn Hills, Michigan. Today it serves more than 200,000 members and has over $2.3 billion in assets.

It has 32 branches locations spread out in Michigan, Minnesota and Pennsylvania, but from those 29 branch locations in Michigan.

You can join then as long as you live in Michigan or in Minnesota and Pennsylvania counties such as:

- Minnesota: Anoka, Dakota, Hennepin, Ramsey, Scott and Washington.

- Pennsylvania: Montgomery.

Its rates:

- Auto rate: APR starting at 1.89%.

- Home equity: APR starting at 1.99%.

- Personal loan: APR starting at 7.74%.

- Certificate special: 0.50% APY for 6 months.

5. United Federal Credit Union

United was established in 1949, but today is serving over 179,000 members and has $3.3 billion in assets.

It's headquartered in St. Joseph, Michigan, while having 44 branches spread out in Ohio, North Carolina, Nevada, Michigan, Indiana, Arkansas.

As long as you are living, working, worshipping or studying near one of its branch locations within the areas mentioned above, then you'll be eligible to join them.

Its rates:

- Auto rate: APR starting at 3.15%.

- HELOC: APR starting at 3.25%.

- Boat & RVs loan: APR starting at 4.95%.

- Ultra checking: APY as high as 3.00%.

6. Michigan Schools and Government Credit Union

MSGCU was founded in 1954, reached $2,772,582,417 in assets as of 2020 and today serves over 130,000 members.

It's headquartered in Clinton Township, MI, but has 17 branch locations.

Membership is open to anyone living, studying, working or worshipping in any located in the State Of Michigan.

Its rates:

- Auto rate: APR starting at 1.74%.

- Visa cards: APR starting at 9.75%.

- Home equity: APR starting at 3.5%.

7. Advia Credit Union

Its headquarters are located in Parchment, MI. This cooperative started in 2014. By the 2020 it overcame the amount of $2.4 billion in assets.

Its 29 branch locations are spread out in Southwest Michigan, Eastern Michigan, as well as Illinois and Wisconsin.

This financial entity serves and provides membership to people located in all counties within the Southern Peninsual of Michigan, but not limited to some counties in Illinos and Wisconsin.

Its rates:

- Auto rate: APR starting at 1.99%.

- Visa Platinum cards: APR starting at 8.9%.

- HELOC: APR starting at 1.99%.

8. Lake Trust Credit Union

Lake Trust was founded in 1944, is headquartered in Brighton, Michigan, serves over 175,000 members and has $1.8 billion in assets.

Membership is open to anyone located in any county within Michigan and it provides with 18 Lake Trust branch locations.

Its rates:

- Auto rate: APR starting at 2.24%.

- Credit cards: APR starting at 8.15%.

- Fixed home equity loan: APR starting at 3.25%.

9. Dow Chemical Employees Credit Union

It started in 1937, headquartered in Midland, MI and reached the amount of $2,002,899,000 in assets as of 2020 and serves over 71,000 members.

You can join whether you are an employee or retiree of Dow inc, The former Dow Corning Corporation and its affiliated companies or related to any of its qualified group of companies.

Its rates:

- Auto rate: APR starting at 2.49%.

- Visa credit cards: APR starting at 6.9%.

- Mortgage: APR starting at 2.583%.

10. Credit Union ONE

Founded in 1937, headquartered in Ferndale, MI, it has 19 branches across Michigan, by the 2020 reached $1,659,764,690 in assets.

You'll be able to join them whether you live, work, study or worship anywhere in Michigan.

Its rates:

- Auto rate: APR starting at 1.99%.

- Home equity: APR starting at 3.99%.

- Mastercard credit card: APR ranging from 8.75 - 16.75%.

Conclusion

You've learned already about the best Michigan credit unions by asset size, locations and rates.

But keep in mind that you should compare which one fit better for you in terms of location, elegibility and your financial needs.

Best Michigan credit unions FAQs

What is the largest credit union in Michigan?

Lake Michigan Credit Union(LMCU) is the largest credit union in Michigan, since it owns $10,443,959,310 in assets as of 6/30/2021, 502,124 members and 59 branch locations.

What is the best credit union to join in Michigan?

In terms of branch locations Lake Michigan Credit Union is the best to join.