Best Credit Unions In Arizona 2021 By Assets And APR

What are the best credit unions in Arizona? Looking for one-on-one assistance in Arizona is possible when you need some financial help.

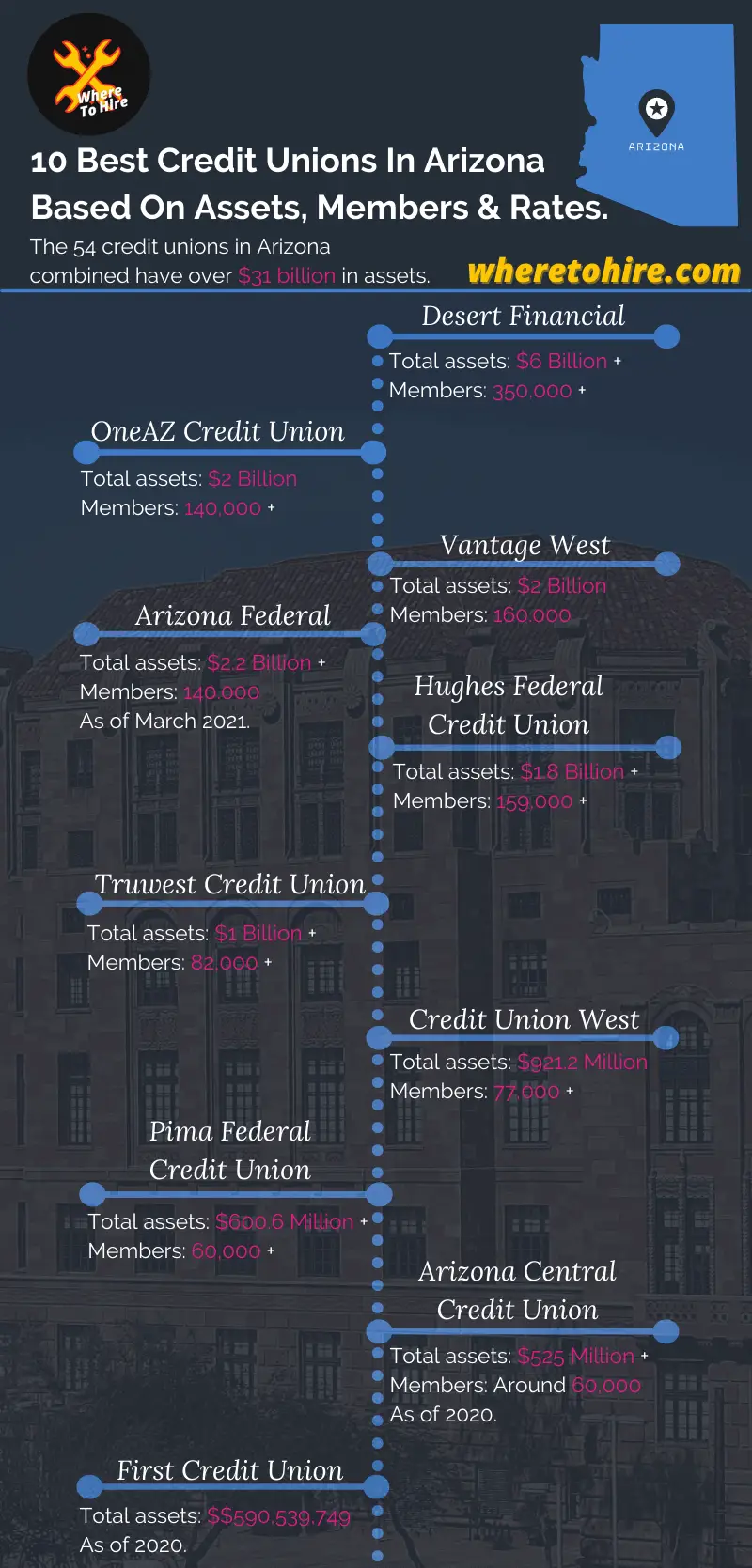

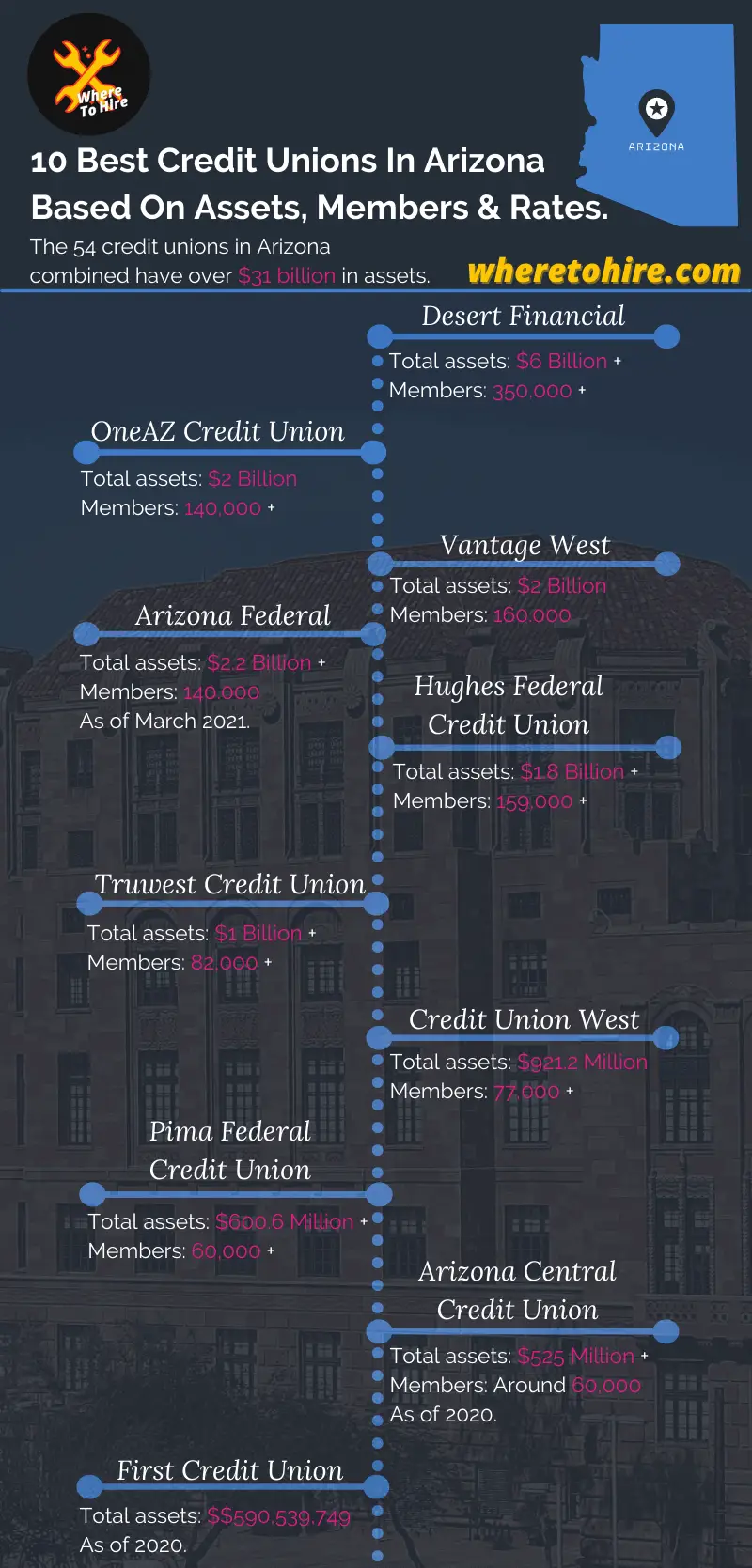

Nowadays there are 54 credit unions in Arizona that combined have around $31,804,002,365 in assets.

In this post you'll learn about the 10 best federal credit unions in Arizona, not only by their assets and number of branch locations, but because of the rates they offer.

Top best and largest credit unions in Arizona you should consider for better rates

1. Desert Financial Credit Union

This credit union was established in 1939 by 15 educators in Arizona. Today Desert Financial is the largest credit union in Arizona, since it has over $6 billion in assets and more than 350,000 members.

Its central offices are located in Phoenix, AZ, provides to members with 50 branch locations and the most of AZ has access to get membership.

Its rates:

- Auto APR: As low as 2.94% for new auto, 3.19% for used auto, while 3.14% for Auto refinance.

- Home purchase APR: As low as 2.383% for 15 year fixed rate, 3.009% for 30 year fixed rate, while 4.001% for FHA 30 year fixed.

- Home refi APR: As low as 2.491% for 15 year fixed, 3.125% for 30 year fixed, while 4.02% for FHA 30 year fixed.

- HELOC APR: 2.99% for the first 12 months, while 4.125% after the first 12 months.

2. OneAZ Credit Union

It started in 1951 serving to Arizonans, today has $2 billion in total assets with over 140,000 members.

This is one of the best credit unions in Scottsdale, AZ and has 22 branches spread out in Arizona.

Membership is open to anyone living in Arizona, students belonging to any of the qualified educational institutions or those who has immediate family relationship with a member on this cooperative.

Plus, this is one of the best credit unions in az for car loans since it offers an APR of 1.74% for new cars.

Its rates:

- Auto APR: As low as 1.74% for new auto, while as low as 1.94% for used auto.

- Credit cards APR: 1.99% as introductory APR for 6 months.

- HELOC APR: 2.79%.

3. Vantage West Credit Union

It started in 1955 with the main purpose to support Tucson's airmen and their loved ones.

Today it's considered as the largest credit union in Southern Arizona with $2.0 billion in total assets, 160,000 members and 33 branch locations in Southern Arizona alone.

Eligible people are those who are living or working in areas such as:

- Cochise, Maricopa, Pima, or Pinal Counties.

- Arizona’s “Copper Basin” Area.

- Gila River Indian Community Reservation.

Its rates:

- Auto loan refinance rate: As low as 1.99% APR.

- New or used auto loan: 2.44% - 18.15% APR fixed.

- Mortgage rate: As low as 2.838% APR.

- Credit cards: Introductory rate as low as 2.99% for 12 months and after as low as 8.25% APR.

- HELOC: As low as 5.00% APR.

4. Arizona Federal Credit Union

It was established in 1936, today owns over 140,000 members and $2.2 billion in assets as of March 2021.

While it's locally based in Valley of the Sun, members of this cooperative will have access to 14 branch locations spread out in the metro-Phoenix area.

Membership is open to people living, studying, worhipping or working in Maricopa or Pinal Counties, as well as The City Of Tucson.

Its rates:

- Auto: As low as 2.69% APR.

- Credit cards: As low as 7.74% APR.

- RV and boats: As low as 4.24% APR.

- Home equity: As low as 4.00% APR.

5. Hughes Federal Credit Union

Founded in 1952 in Tucson, Arizona, today this cooperative has over 159,000 members and owns over $1.8 billion in assets.

This cooperative has 7 branch locations spread out in Tucson, AZ and everyone living, working, worshipping or studying in Tucson will be eligible to become a member.

Its rates:

- New/used car and trucks: As low as 4.75% APR.

- Motorcycle & ATV loans: As low as 5.50% APR.

- RVs: As low as 7.00% APR.

- Unsecured loans: 13.45% APR for line of credit.

- Visa & credit card: 9.50% - 12.50% APR.

- Savings pledge loan: As low as 2.15% APR.

- Credit builder loans: As low as 10.75% APR.

6. TruWest Credit Union

It was established in 1952, when started serving its members located in Austin and Phoenix.

Truwest has 8 branch locations in Arizona, while 4 branches in Texas, owns over $1 billion in assets, serving more than 82,000 members and is one of the best rated credit unions in Arizona by Forbes.

Membership is open to people living, working or having a business in counties such as Maricopa, Pima, Pinal or Yavapai, Arizona.

It also provides membership for people living, studying, woking or operating a business in Travis or Williamson County, TX.

- Auto: As low as 3.65% APR.

- Mortgage: As low as 2.699% APR.

- Investment certificate (60 month): 0.60% APY.

- Credit cards: As low as 5.95% APY.

7. Credit Union West

It started in 1951, headquartered in on Luke Air Force Base with the main purpose on helping military members.

Today it owns over 77,000 members, $921.2 million in total assets and 14 branch locations.

Membership is open to anyone in Yavapai, Pinal, Pima, Navajo, Mohave, Maricopa, Gila, Coconino, Cochise, or Apache.

Its rates:

- Auto loans: As low as 2.99% APR.

- Home equity: As low as 3.75% APR.

- Credit cards: As low as 8.49% APR.

- Mortgages: As low as 2.60% APR.

- Checking: Up to 1.06% for APY.

- Certificate: Up to 0.65% for APY.

8. Pima Federal Credit Union

Established in 1951 by 16 teachers, today it's over $600.6 million in assets and serves over 60,000 members.

It has 8 branch locations spread out in Tucson, AZ and memberships are open to people who live, work, worship or study in Apache County.

This is also one of the best credit unions in Arizona for auto loans, since like OneAZ, it offers an APR as low as 1.74%.

Its rates:

- New or used car loans: As low as 1.74% APR.

- Personal loan: As low as 9.00% APR.

- Personal line of credit: 13.75% APR.

- New RVs: As low as 5.75% APR.

- Used RVs: As low as 6.25% APR.

- New or used motorcycle: As low as: 5.75% APR.

- Share and term share secured loans: The APR is the current dividend plus 2.50%.

- Home rates: As low as 2.284% APR.

9. Arizona Central Credit Union

Since 1939, Arizona Central Credit Union has been serving people in Phoenix, AZ with financial services.

Today has over $525 million in assets and around 60,000 members.

It has 9 branches throughout Arizona, including Chandler, Flagstaff, Glendale, Phoenix, Show Low, Tempe and Tucson.

This is also one of the good credit unions in Arizona in terms of elegibility, since membership is open for everyone who is U.S resident.

Its rates:

- Mortgages rates: As low as 2.829% APR.

- Auto rates: As low as 3.00% APR for new autos, while starting at 3.40% APR for used cars.

- Credit Cards: As low as 10.9% APR for Visa® Gold card.

- HELOC: As low as 5.078% APR.

10. First Credit Union

In this list, this is the oldest credit union in Arizona, since it was established in 1929.

By the 2020 it reached the amount of $590,539,749 in assets and has 8 branches spread out in Phoenix and Tucson metropolitan areas.

You'll be eligible to join as long as you live, work, worship or study within a 10 miles radius of any of its branches.

Its rates:

- Auto rates: As low as 3.04% APR for new cars, while starting at 3.29% APR for used cars.

- HELOC: 4.50% APR.

- Home equity: 4.75% APR.

- Personal rates: As low as 9.90% APR for signature loan.

- Shared securd loan: 6.00% APR.

Conclusion

A financial cooperative in Arizona, is an easier way to get financial help.

But keep in mind that based on your elegibility in terms of locations, will be determined if you can access the lowest rates for loans or not.

Arizona Credit Unions FAQs

What is the largest credit union in Arizona?

Desert Financial is the largest credit union in Arizona, since it has over $6 billion in assets, more than 350,000 members and 50 physical locations.