What Is Banking, How Does It Work And Why Is It Important?

What is banking, how does it work and why is it important?

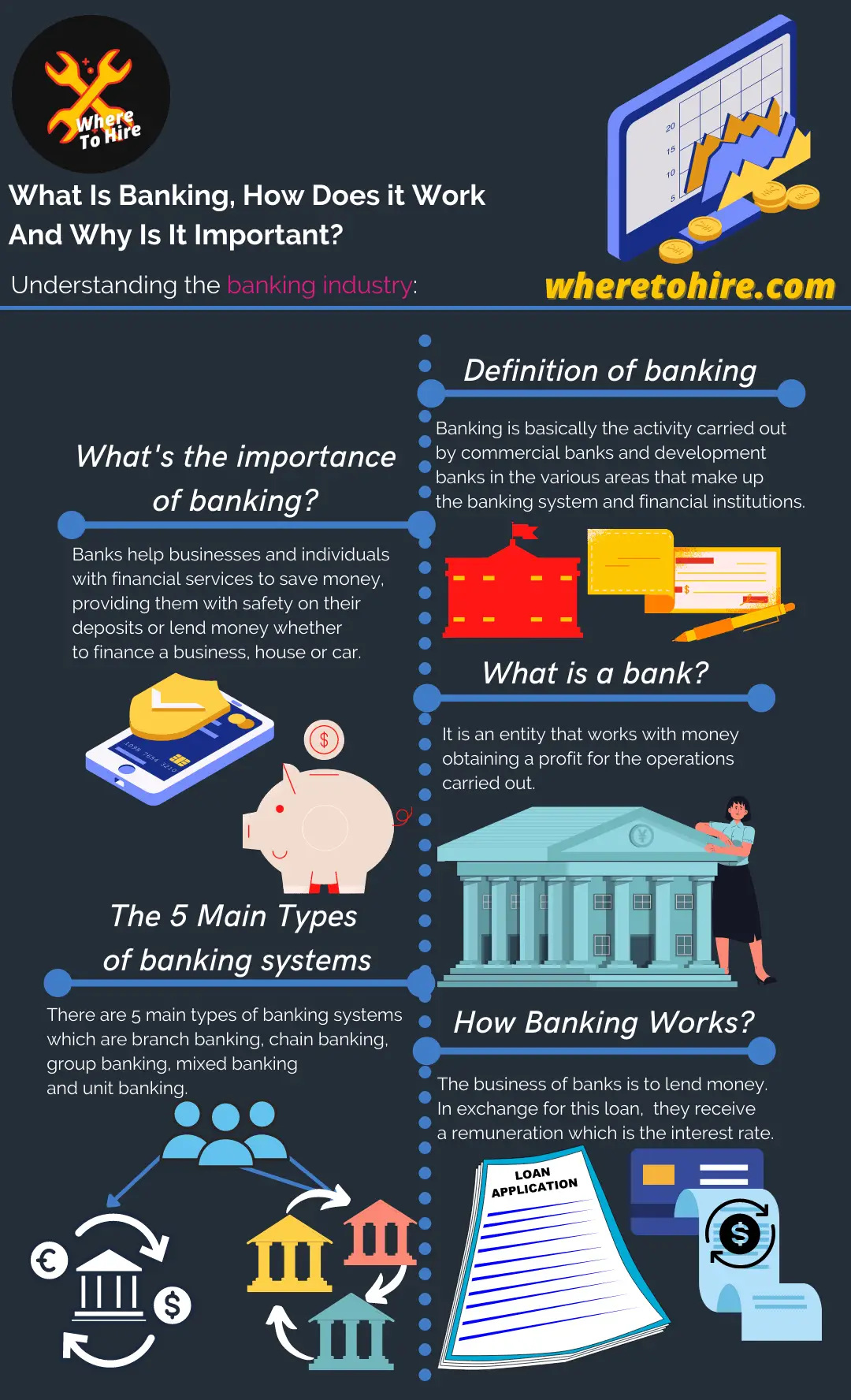

Banking is basically the activity carried out by commercial banks and development banks in the various areas that make up the banking system and financial institutions, these being the ones that accept money in the form of a deposit to later, based on their own resources, grant credits, discounts and other financial operations for which it charges interest, commissions and expenses, if applicable.

In itself, banking industry is also the result of the set of financial institutions or entities that perform the function of bank.

What is a bank?

It is an entity that works with money, obtaining a profit for the operations carried out such as loans, deposits, comissions by transactions or savings account provided to their customers.

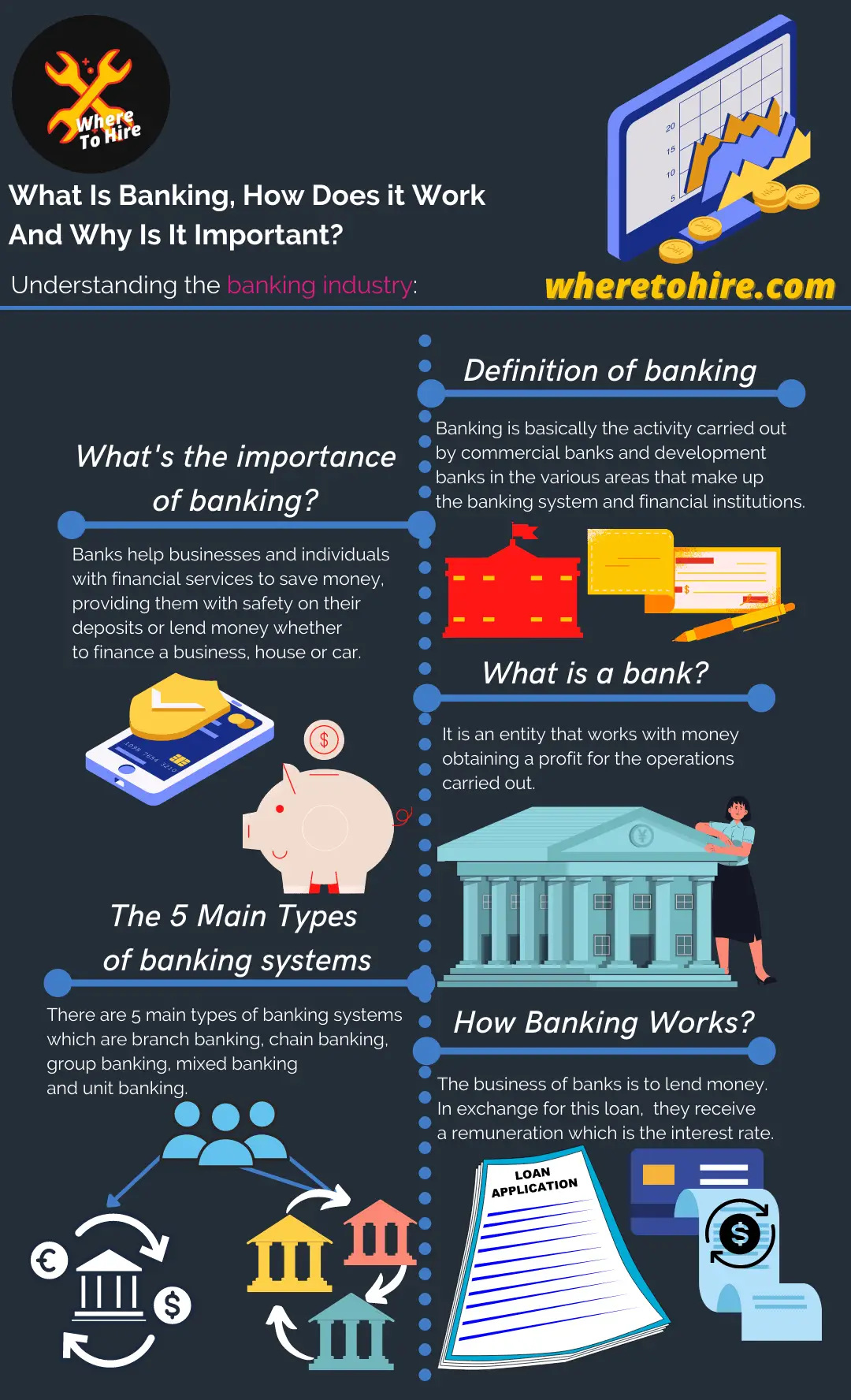

How does banking work?

The business of banks is to lend money. In exchange for this loan, they receive a remuneration, which is the interest rate.

In order to carry out the activity of receiving money and then lending it, banks charge those who need it and ask for loans; likewise, those who give them money on deposit are paid for the trust placed in them. The difference between what they are paid and what they pay represents one of the bank's businesses.

Where do they get their money from? Basically, it can come from these sources:

- Money deposited by savers with the institution, in the form of checking accounts, deposits and other financial instruments.

Bond issues and other types of debt (for which it pays an interest rate to the investor).

Debt securitizations, by means of which they obtain money with the guarantee of some asset, for example, a mortgage.

Financial intermediaries: interbank loans obtained from other entities (this is the part that was most affected at the beginning of the crisis, when banks did not trust each other).

Capital and profits obtained by the institution and accumulated in the form of equity.

What is the importance of banking?

The banks help businesses and individuals with financial services to save money, providing them with safety on their deposits or lend money whether to finance a business, house or car.

Banks also let bank account holders to transfer money from one bank account to another, locally or internationally. In a nutshell, banks are important so a country or nation be able to manage and supply its financial needs.

There are 5 types of banking systems

1. Branch banking

It is a banking system of financial institutions which employ physical locations spread out a nation or worldwilde to supply their customers with the financial assistance they provide such as deposit, withdrawals through the cashier or ATMs, and financial advice. See the advantages and disadvantages of branch banking.

2. Chain banking

Chain banking is a banking system that is the product of a small group of people who govern at least 3 independently managed banks.

3. Group banking

It refers to banking provided to a specific group of people with services customized to their needs or to the formation of a holding company in control of several banks.

This banking system bacame popular in the United States of America between 1925 and 1929.

4. Mixed banking

This is the banking model that combines the characteristics of commercial banking and industrial banking, acting interchangeably in both areas.

5. Unit banking

Unit banking refers to a banking system formed by an unique and small bank which provides bank services to a specific local community.

Examples of banking

1. Commercial banking

The retails or commercial banks are in charge of granting loans, credits and organizing financial resources for the population, ensuring continuity in the country's economic activities.

2. Merchant banking

Merchant banks offer lending, financial advisory and investment services for large corporations or small businesses, but are not limited to serving high net worth individuals (HNIs).

3. Investment banking

Investment banking is the banking segment that is mainly responsible for obtaining funds, raising capital, or other financial resources so that different entities can make short or long term investments.

It is also in charge of negotiating with large companies, in search of profitability for clients and shareholder investors, in order to be able to trade in the capital markets of different countries.

4. Development banking

Development banking is a type of banking system which focuses on giving financial priority to the National Economic Plan to support different sectors and therefore development, these being part of the Public and Federal Administration.

5. Community banking

A community bank supports local families and businesses on a specific geographic area by providing them with financial assistance and investing in their own communities.

Customers of a community bank may have a stronger or closer relationship than they might have with a large bank.

6. Private banking

Private banking is a highly professional and comprehensive management of a client's wealth. It is about meeting the investment, estate planning, financial and tax needs of individuals or family groups with high net worth.

7. Credit unions

A credit union unlike a traditional bank, is a not-for-profit organization, smaller than a bank, that is focused on serving its community members, who are also its owners who share a common bond, by providing them with financial services as banks, rather than just making profits for shareholders like most banks.

8. Online banking

Also known as internet banking, online banking is a system of financial services provided through the web, with the purpose on making easier for customers their financial management by using a computer.

Although most banks today offer digital banking, there are branchless banks that only provide their banking services through the web.

Conclusion

Banking industry is so important for the development of a country's economy. There are different types of banking system which operates based on their functions and business structure.

Banking FAQs

What do you mean by banking?

A financial industry that consists of financial institutions which performs operations such as lending money or accepting deposits.

What are the types of banking?

Branch banking, chain banking, group banking, mixed banking and unit banking.