What Are The Best Banks In Florida For Personal Banking 2021?

What are the best banks in Florida for personal banking? Managing your financial movements it's better when there are little or no monthly fees.

But a good customer service, branches and ATMs locations near you, are a must to access and manage in order your financial needs.

That's why we took the task of analyzing the best financial institutions for individuals in Florida.

5 Best banks in Florida you should consider for your personal banking

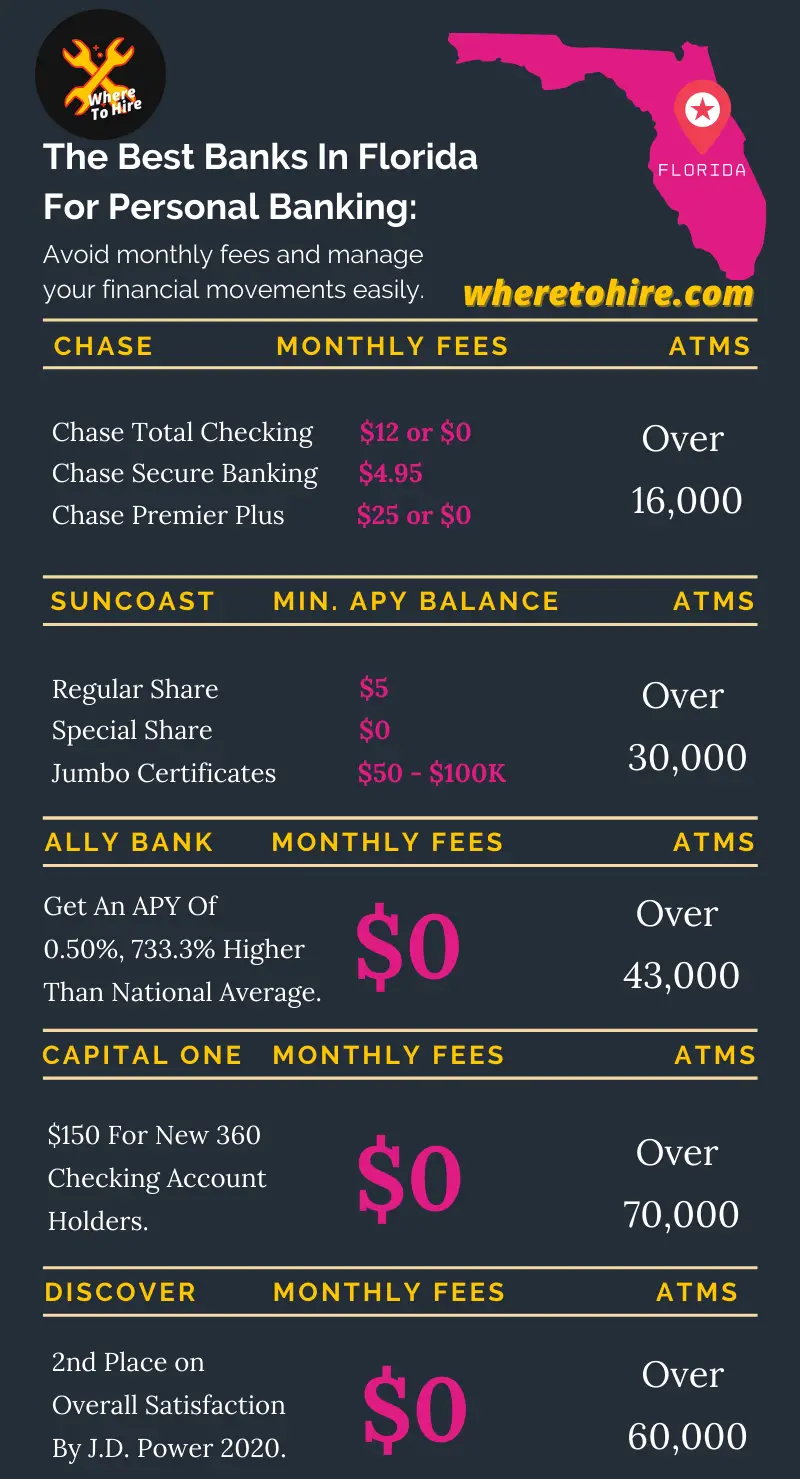

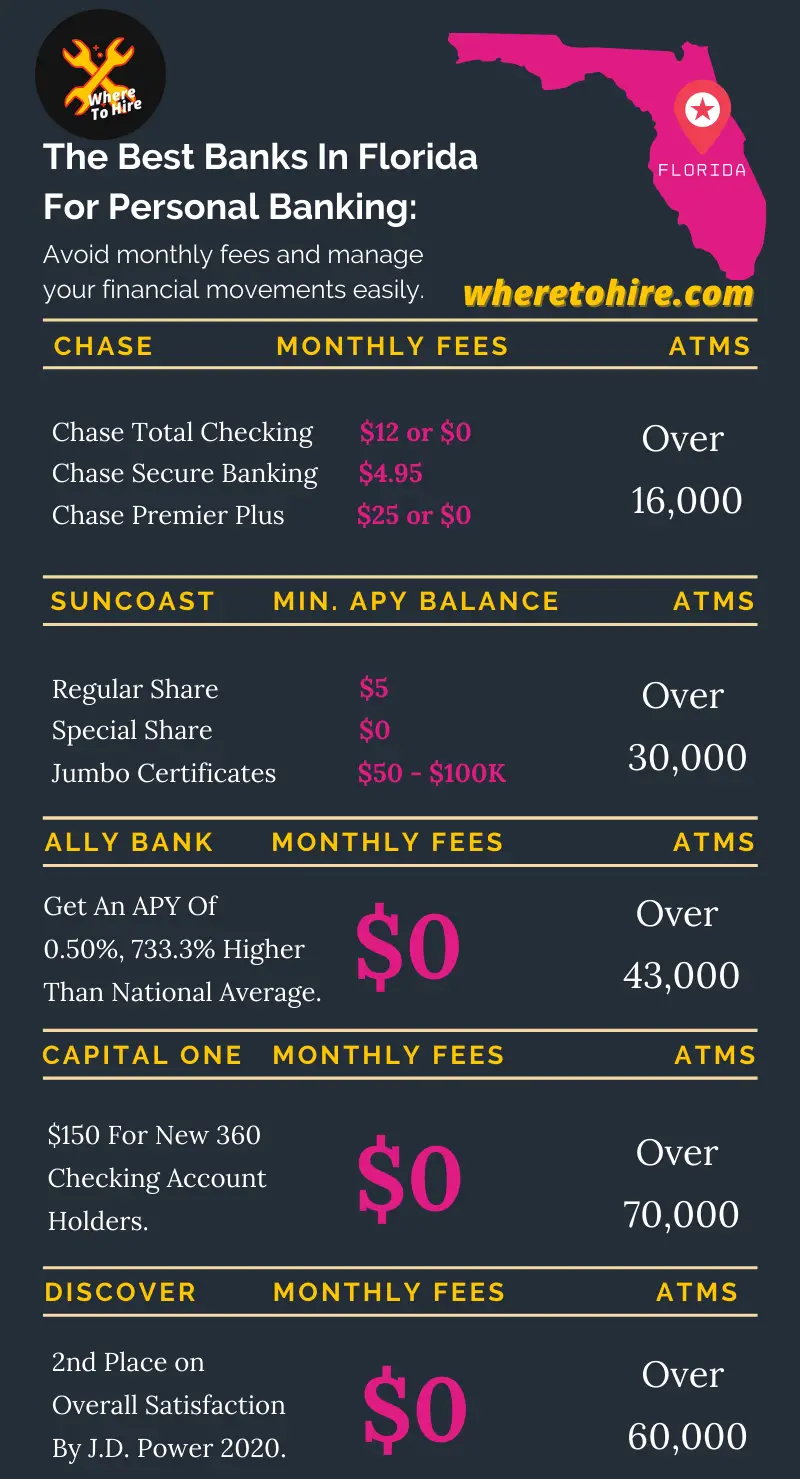

1. Chase bank

Not only one of the biggest banks in Florida, but one of the best banks in United States. This bank offers financial services such as loans, credit cars, investment options, mortgages, as well as savings and checking accounts.

The downside is that its APY is low, since it's only 0.01%, which is pretty less than the national average, but you can open your account by $0. Here you go with the some products they offer for individuals:

- Chase Total Checking: $12 or $0 monthly by making an electronic deposit of $500, a minimun daily balance of $1,500 or $5,000 or more.

- Chase Secure Banking: $4.95 per month.

- Chase Premier Plus Checking: $25 or $0 monthly.

You can enjoy $225 by opening an account and setting up a direct deposit, while universitaire students can enjoy $100 in their new Chase College Checking account.

- Branches: Over 400 branches in Florida, but more than 4,700 branches across the US.

- ATMs: Over 16,000 across the US.

2. Suncoast Credit Union

Suncoast offers the advantages of a credit union. In fact, it's one of the largest credit unions in Florida that offers you mobile and online banking, along with banks services such as savings and checking accounts.

The savings account offered by this bank are:

- Regular Share Membership: Minimum balance of $0, APY of 0.050%.

- Special Share: Minimum balance of $0, APY of 0.050%.

- Jumbo Certificates: It offers Jumbo certificates which start from $0 up to $100,000 for minimum balance, and from 0.050% up to 0.950% in terms of APY.

You can open its smart checking account with an initial deposit of $0, minimum balance of $0, and an APY of 0.010%.

- Branches: 74 branches in Florida.

- ATMs: Over 30,000 ATMs across the US through the CO-OP Network.

So you be eligible to open an account with this entity, you'll need match at least one of these three requirements:

- Having a immediate family member who is already a member of Suncoast.

- Live in one of the Florida's conties served by this institution.

- Be a Florida College graduate student.

3. Ally Bank

Ally Bank offers several online tools such as bucket and booster, so you can manage your savings and optimize your earnings respectively.

Keep in mind that since there are not physical branches, you won't be able to deposit cash.

Anyway, you can deposit checks electronically, take advantage of its high quality customer service via chat, email or over the phone and have the peace of mind that there will not be monthly maintenance fees.

It also offers you an annual percentage rate of 0.50%, which place it as one of the high-yield savings accounts online, and even higher than our next bank on this list, which is Capital One.

- Branches: 0.

- ATMs: Over 43,000 Allpoint's ATMs nationwide.

4. Capital One 360

Similar to Chase, Capital One offers separate savings and checking account options, but with the big difference on a high-yield fee free savings account of 0.40% in APY, which is super high compared to the national average.

Although there are not minimum balance requirements, this bank pays $150 to new 360 checking account holders.

When it comes to customer satisfaction, J.D. Power rated Capital One with 688/1,000 as of 2020.

This bank also stands out due to their 24/7 mobile and online banking, but by their bank account options for teenagers.

- Branches: 7 branches in Florida, while 744 across the US.

- ATMs: Over 70,000 ATMs nationwide.

5. Discover Bank

This bank is mainly a digital financial entity, which according to J.D. Power, Discover Bank ranks second, with a score of 862/1,000 in terms of overall satisfaction.

On the other hand, according to Nerdwallet, Discover Bank is the winner as of 2021, for best checking account with no monthly fee.

Key takeaways about Discover Bank:

- Forget about monthly fees on any of its offered accounts.

- Overdraft fees of $0.

- You won't need to hold a balance on your personal account.

- APY up to 0.50%.

This company provides you with a 1% cashback for every $3,000 purchased through your Discover debit card.

- Branches: 2 Banking locations.

- ATMs: Over 60,000 ATMs nationwide.

Conclusion

Now you now which financial entities are the best for Florida residents who want to open a savings or checking account.

Now it's up to you on deciding if you are looking for several branch locations, high interests, or simply opening and managing your online banking by paying $0 fee.

Banks in Florida for personal banking FAQs

Which bank is best for personal account?

Discover Bank, since it's the 2nd winner in overall satisfaction, according to J.D. Power.

What Florida banks offer free checking?

- Suncoast Credit Union.

- Ally Bank.

- Capital One 360.

- Discover Bank.